Growing Market Opportunities for L&AH Insurers

Life is expensive. Life insurance is not. The reason that today’s customers need life insurance more than ever is that life is expensive. They need to make sure that they (and their families) are covered for unforeseen circumstances. But customer logic in this regard works backward. Many people feel life is too expensive to afford them the “luxury” of life insurance. The problem begins with two misconceptions. According to LIMRA, 72% of consumers overestimate the cost of a basic term life insurance policy,[i] and many don’t understand it and how it would fit their financial plan.

Look at other products such as dental, vision, accident, and supplemental health, and you’ll see that life insurance isn’t the only product to suffer from economic pressures and common misconceptions. Individual, Worksite, Group and Voluntary Benefits insurers are under pressure to grow the business while operational costs are rising and customers are cutting many types of insurance from their budget, resulting in a growing protection gap. How does the industry convince customers that they need to prioritize financial protection?

State of the L&AH Market

The good? L&AH products are among the least likely insurance types to be shopped around. The bad? Because they are not mandatory, they are some of the least likely insurance products to get purchased in the first place. We see this when it comes to insurance gaps. According to a recent Majesco survey, less than 50% of potential voluntary benefits insurance customers take full advantage of their employers’ benefits offerings. How can we turn the tide?

Insurance intelligent solutions might answer both insurer and customer issues regarding price and education across all types of Individual, Worksite, Group, and Voluntary products. It will be made possible by a growing willingness by customers to share their personal data, coupled with an insurer’s ability to analyze it and use it effectively to underwrite and personalize offerings.

Customer data-sharing could lower premiums, improve claims ratios and engage customers who otherwise would have opted out. How can intelligent solutions for the insurance industry be used to grow market opportunities, decrease the protection gap, and secure the health and financial future of millions of individuals and families That’s one of the questions Majesco set out to answer in its Thought Leadership report, From Trust to Technology: The Tipping Point for Insurance Customers.

Turning Stats into Strategies

Every once in a while, it is time to consider statistics from the perspective of action. A question should be asked, “Does the data point toward a move that should be made in our business?” In the case of Individual, Worksite, Group and Voluntary products, there are, in fact, relevant shifts in customer demographics and mindset that do require a good look. Before we try to change the mind of the customer, can we change our own minds on how we will approach growing our business?

To help, Majesco often segregates our survey data into age-related groups to find out if we can see predictable or unpredictable mindset shifts happening within those groups.

Gen Z and Millennial Opportunities

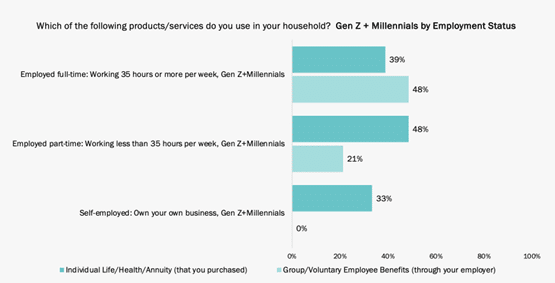

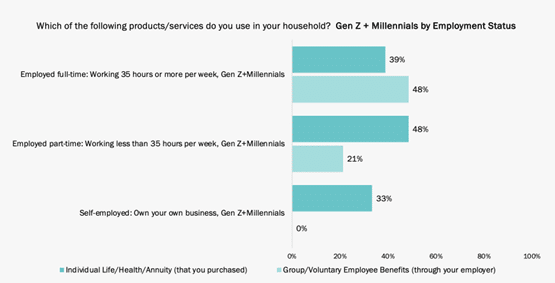

Majesco’s insurance customer survey results reflect a significant opportunity for individual, group, voluntary benefits and worksite in the Gen Z and Millennial segment. As highlighted in Figure 1, only 39% of those working full time have individual life, health, or annuity, and only 48% have employee benefits, highlighting a significant protection gap for this generation.[ii]

Even more concerning, only 48% of part-time workers have individual and a paltry 21% have employee benefits, exacerbating a protection gap. Given that this generation moves regularly between jobs, the need to reach them with products they can take with them between jobs, whether full-time or part-time, is crucially important, making individual and worksite products a great market opportunity for insurers.

Figure 1: Gen Z and Millennial individual and group/voluntary protection gaps

Among those with individual or benefits products, only 30% and 24% respectively, said the cost of their coverages has increased somewhat or significantly. Though this may seem low, it is high when you consider how it exacerbates the financial challenges this generation faces, and it is likely why there is such low ownership of products. The products are not mandatory. Is the mental incentive for insurance high enough to overcome the discomfort of insurance prices? Who is selling the customer on the ideas and products…or are they coming to the conclusion that they must buy on their own? Can an increase in employer participation offset the losses of those who decline voluntary benefits year to year?

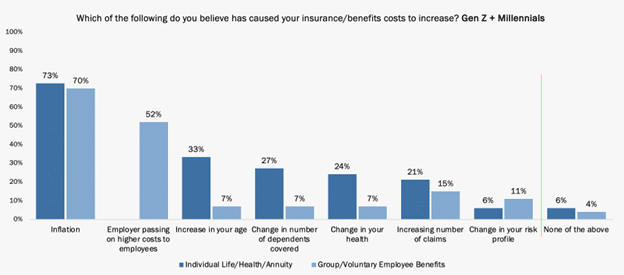

Gen Z and Millennial perceptions on cost increases in L&AH

Inflation is the most cited reason for the increase in L&AH insurance costs, as seen in Figure 2. Employers passing on higher benefits costs is another major driver of benefits (52%) cost increases. Contrary to this, individual cost increases were primarily focused on age, number of dependents, health and rising claims – all relatively about the same in perception.

Figure 2: Gen Z & Millennial customers’ perceived causes of increases in cost of L&AH insurance

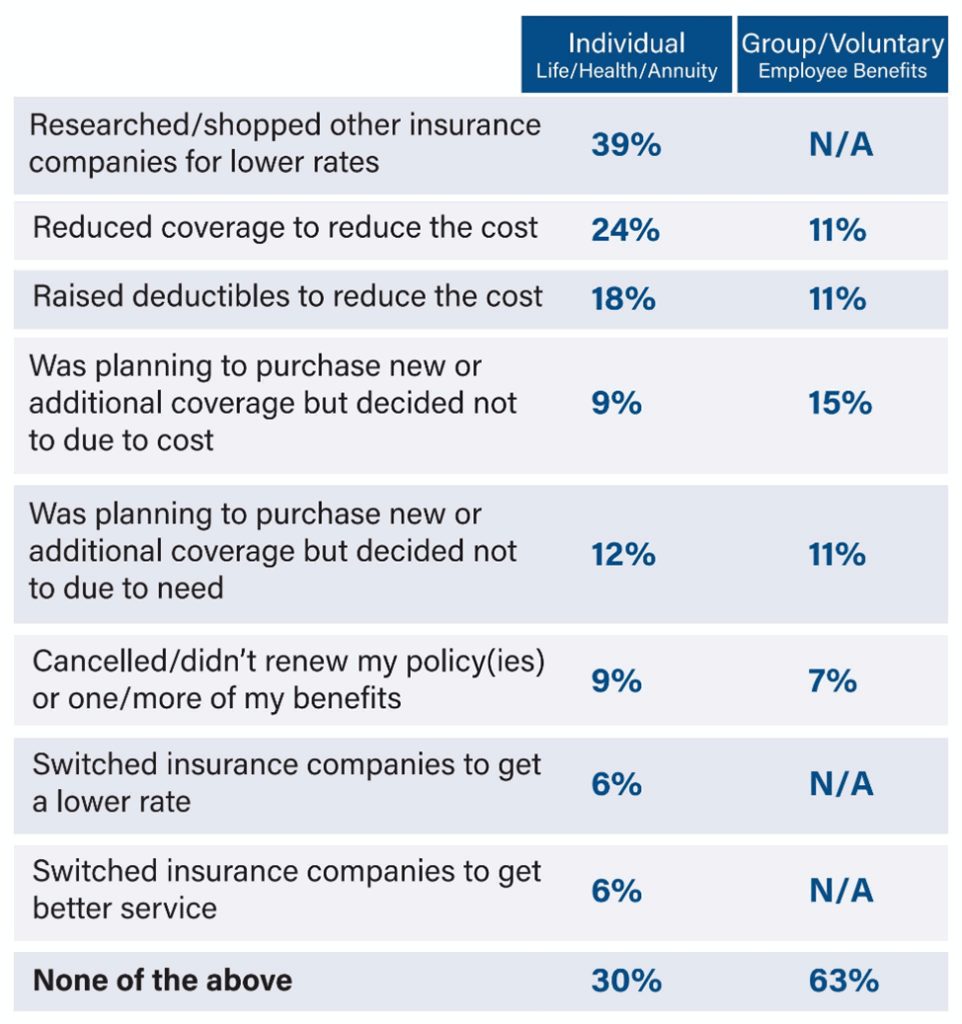

Only a handful of options to look for lower individual prices were undertaken by this generation, as seen in Table 1. The three most significant actions were researching/shopping other insurance companies (39%), reducing coverage (24%), and raising deductibles (18%). Given the nature of benefits packages defined by employers, very little action was taken.

However, for those with benefits, 11% reduced coverage and raised deductibles to manage their costs – likely for more health-related benefits – while 15% decided not to add more coverage due to cost. This highlights the challenge for group and benefit insurers to enroll this generation into more products beyond their health-related products (i.e., medical, vision, and dental) and consider individual and worksite products.

Table 1: L&AH insurance-related actions done this year by Gen Z & Millennial customers

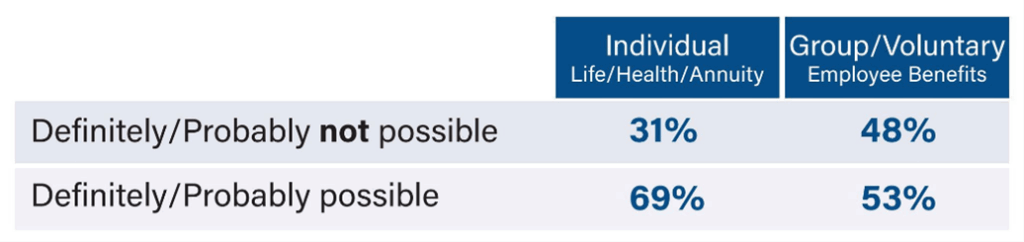

There is a significant belief that this generation can reduce their risk and have lower costs for individual (69%) and benefits (53%) as seen in Table 2.

Table 2: Gen Z and Millennial customers’ belief there are things they can do to reduce risk and chances of having a claim, which could lead to a lower price for their L&AH insurance

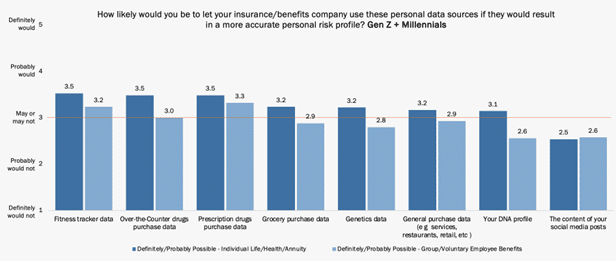

Among those who strongly felt this way, they are more open to using their personal data sources to develop a more accurate personal risk profile that could change their rates, as seen in Figure 3. The strongest interest for both customer groups is for fitness tracker data, and over the counter drugs and prescription drugs purchase data, all rated at 3.5. However, they are split in their views on using DNA profiles, with individual customers rating it 19% higher.

Figure 3: Gen Z & Millennial customers’ likelihood to use personal data sources for L&AH insurance pricing

In comparing the 2022 and 2024 results, the likelihood of using some personal data sources has declined slightly across the board, highlighted by a 17% decline for content of your social media posts, 12% decline for grocery purchase data, general purchase data, and DNA profile, and 9% decline for genetics data. This may be due to a better understanding of personal data privacy and an increase in high-profile data breaches. It should be noted, however, that Gen Z and Millennial willingness to share data is still high, especially for fitness, prescription, and general purchase data — a reflection of the new buyer.

If Gen Z and Millennials are willing to share data into their lifestyles, especially their risk and health-related data, they will naturally be looking for voluntary products that give a nod (or rewards) to their efforts to get and stay healthy. A healthy employee is a more productive and less expensive employee, making employers key partners in this exercise. For privacy reasons, most employers can’t directly track employee health data or their use of health-related tools, but they can promote products that are tied to incentives. They can also promote the lifestyles that lead to better life and health outcomes.

Insurers need to ask themselves, “In what ways are we partnering with employers to gather and utilize data insights using insurance intelligent solutions, including AI solutions for insurance?”

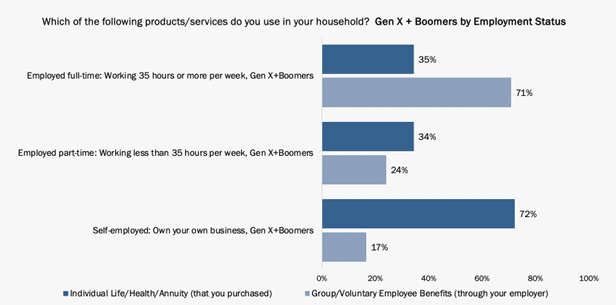

Gen X and Boomer opportunities aim at longer-lasting benefits

There is a significant opportunity for individual, group, voluntary benefits, and worksite in the Gen X and Boomers market segment in the different work categories. While a strong 71% of those working full time have benefits, only 35% have individual life, health, or annuity, as seen in Figure 4. As this generation retires, the need for individual products such as life, LTC, dental, vision, Med Supp, and other supplemental health products is crucially important and represents a great growth opportunity. This is where individual and worksite is a great way to buy the products while employed and keep them upon retirement, and why this is a growing market opportunity.

Of concern is the part-time employees who have very low use of both benefits (24%) and individual (34%) products, highlighting a significant protection gap. Insurers have a large opportunity to package together benefits for part-time employees, including individual products sold via worksite, to help close this gap and grow their business at the same time.

Figure 4: Gen X and Boomer individual and group/voluntary protection gaps

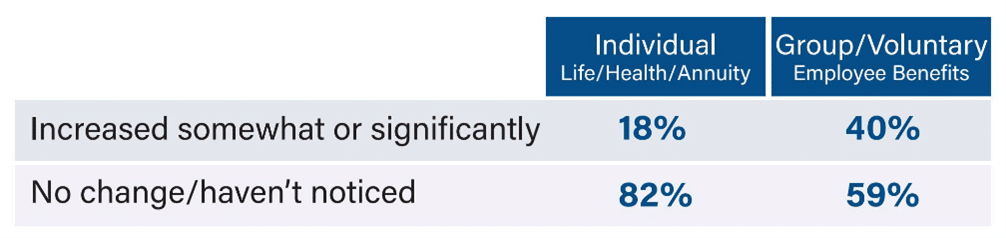

More than twice as many consumers with benefits products said the cost of their coverages has increased somewhat or significantly compared to individual consumers, 40% versus 18% as shown in Table 3. This increase is likely due to two factors: employees taking on more of the cost and the continued rise in the cost of health insurance. The challenge for voluntary benefits insurers will be that this rise in cost will continue to squeeze the ability or desire of consumers to buy other benefits-related products, limiting insurer growth.

Table 3: Reported changes in L&AH insurance costs by Gen X & Boomer customers

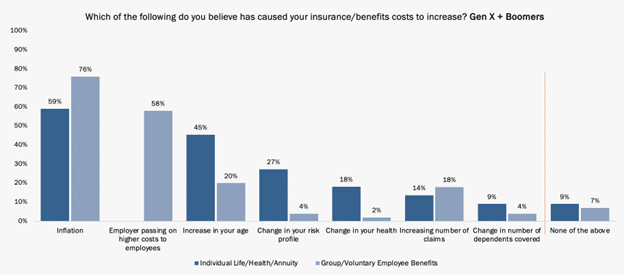

Once again, inflation is the most-cited driver of increased insurance costs for both individual and voluntary benefits products, as seen in Figure 5. Employers passing on higher costs is the second highest reason for benefits increases, at 58%, highlighting the challenges for group and benefits insurers.

For individual products, the obvious top reason was age (45%) for this generational group due to the advanced ages. Risk profile (27%) and change in health (18%) were the next two reasons, once again reflecting the increased cost of buying individual products later in life or post-retirement. This highlights another reason why insurers should consider worksite and individual products for employees at younger ages to help them more effectively retain cost-effective coverage as they age.

Figure 5: Gen X & Boomer customers’ perceived causes of increases in cost of L&AH insurance

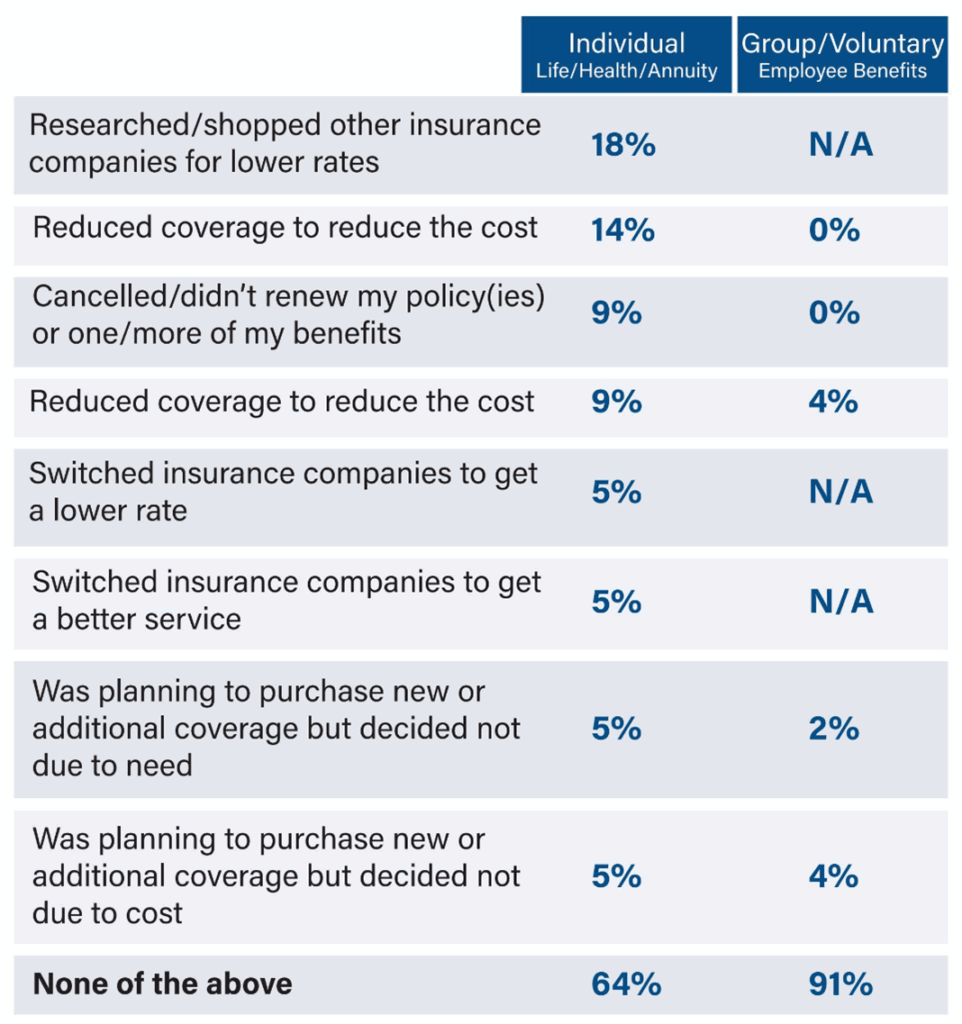

Despite 40% of benefits consumers experiencing cost increases, nearly all (91%) did not attempt any cost-saving activities, as seen in Table 4. In addition, only two cost-saving actions were taken by more than 10% of individual consumers, including researched/shopped other insurance companies (18%) and raising deductibles (14%).

Table 4: L&AH insurance-related actions done this year by Gen X & Boomer customers

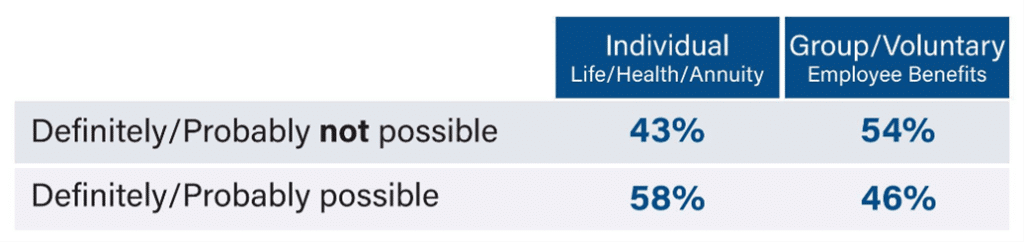

Even though very few consumers attempted any cost-saving actions noted above, they expressed surprisingly strong belief they can reduce their risk and chances of having a claim, potentially leading to lower insurance costs, with 58% of individual and 46% of benefits consumers indicating so, as noted in Table 5.

Table 5: Gen X and Boomer customers’ belief there are things they can do to reduce risk and chances of having a claim, which could lead to a lower price for their L&AH insurance

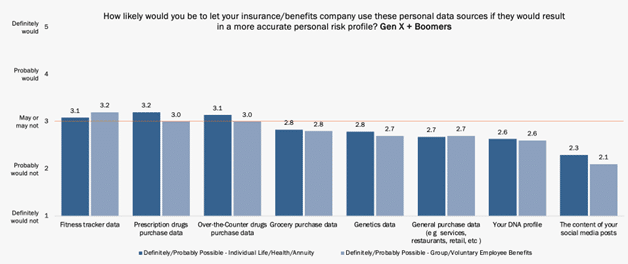

There is considerable consistency between individual and voluntary benefits consumers in considering use of personal data sources to develop more accurate personal risk profiles that could change their rates, as seen in Figure 6.

The strongest interest for both consumer groups is for fitness tracker data, and over-the-counter drugs and prescription drugs purchase data, all rated at the mid-point level of interest. Grocery purchase data, genetics data, general purchase data, and DNA profiles all hover just under the mid-point. Consistent with all other segments in the survey, the content of social media posts is the least popular option.

Figure 6: Gen X & Boomer customers’ likelihood to use personal data sources for L&AH insurance pricing

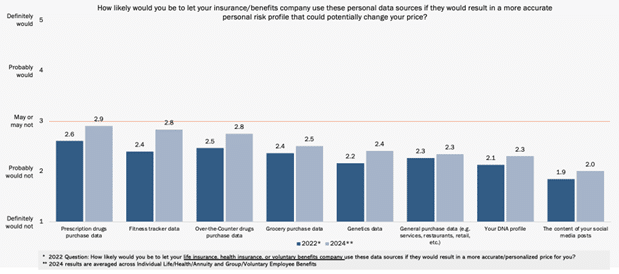

Insurers, Employers and Employees are Growing Closer on Data Use

We gathered 2022 survey opinions about the use of these data sources and compared those to the 2024 survey. The key takeaway is the opposite of what we saw with Gen Z and Millennials, with Gen X and Boomers average ratings in 2024 higher than in 2022 across the board, as shown in Figure 7. It was led by an 18% increase in interest for fitness tracker data, a 12% increase for prescription and over-the-counter drug purchase data, and an 11% increase for genetics data. Surprisingly, even DNA data and the content of your social media posts scored 8% higher as compared to 2022.

Figure 7: Gen X & Boomer customers’ likelihood to use personal data sources for L&AH insurance pricing, 2022 vs. 2024

This opinion shift AND its converse relationship to what would have been expected (privacy-related drops more in line with Gen Z and Millennial shifts) should provide individual, worksite, group and voluntary benefits insurers with enough fuel for their own mindset flip.

If the older generations are beginning to show greater willingness to utilize their personal data to garner price improvements, then a tipping point has occurred. Insurers should show no hesitation in implementing their insurance growth and data strategies — building and perfecting their data frameworks and using insurance intelligent solutions to create more meaningful engagement with individual customers, group and voluntary brokers, and employer customers.

Now is the time to employ insurance solutions with embedded analytics, such as Majesco’s Intelligent Core Suite for L&AH and Generative AI and Agentic AI solutions in insurance, such as Majesco’s Data & Analytics architecture for insurance. For a deeper dive into what is now possible, tune into the Majesco webinar, Unlocking the Power of Majesco’s L&AH Intelligent Core Delivering Personalized, Agile, and AI-Enabled Insurance Experiences.

[i] 2024 Insurance Barometer Study, LIMRA, July 15, 2024 [ii] Garth, Denise and Glenn Westlake, From Trust to Technology: The Tipping Point for Insurance Customers, Majesco, October 2024

The post Growing Market Opportunities for L&AH Insurers appeared first on Majesco.