New Technologies Energizes MGA Innovation Opportunities: MGAs Must Prioritize Strengths to Capitalize

It’s tornado season in the Midwest region of the United States, and this year’s crop of twisters (49 of them alone last week!) has already proven to be extremely forceful and damaging. What makes tornadoes so impressive and frightening is the speed with which they can begin and their unpredictable nature. Unlike hurricanes, no one is tracking tornadoes for days before they hit. They are tracking the trends that might cause tornadoes. There is almost no time to prepare. If you want to outsmart a tornado, you must be prepared before the storm begins. Once they touch down, nothing is certain.

Risk and insurance are currently in a sort of tornado alley. Not only is climate risk spinning insurers in circles, but the unpredictable nature of new risks and the severity of claims on traditional insurance are begging the industry to innovate with more resilient products and business models. Preparing is the only option.

Enter the MGAs, who themselves have taken the industry by storm. They can certainly be part of a holistic solution to cover ancillary markets and produce innovative new coverages for a world that needs protection.

With their unique position in the market, MGAs have key competitive differentiators that distinguish them from the rest. These include niche and product expertise, strong partnerships, personalized customer and agent experiences, flexible MGA business models, optimized operations models, and a focus on innovation. New MGAs have one distinct operational advantage. They are setting up their operating model and technology foundation from the bottom up – with no legacy debt. This will make them more responsive and better prepared than some traditional operational models.

MGAs recognize the challenges of today’s marketplace with increasing risk and the demand for both traditional and new products, so they have designed MGA innovations to meet old needs with new products and meet new needs with innovative ideas. Their fresh business practices will fall flat, however, without MGA insurance software solutions that can enable unique product launches and fit them into the spaces MGAs have carved out already.

Constructing a solid operating and technology foundation, as highlighted in their strategic priorities, is more important than ever. It will allow MGAs to focus on their value to the market. For an in-depth dive into MGA strategies for innovation and growth, be sure to read Majesco’s MGA Strategic Priorities Report for a peek into what MGA leaders are thinking (and doing) about the new world of risk.

Strategic Initiatives Reflect the Time and the Need

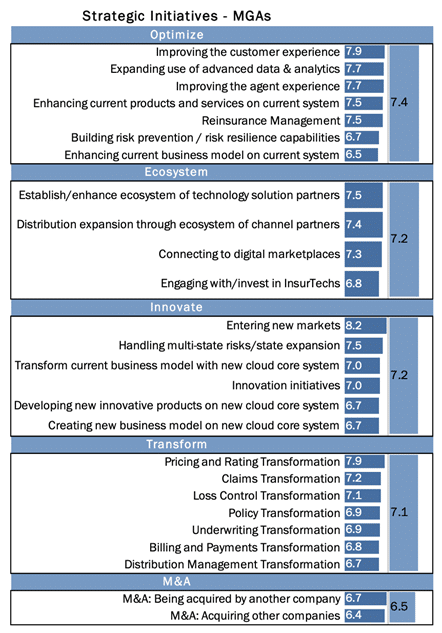

Majesco’s report organized strategic initiatives into four categories with an additional category for M&A, as reflected in Figure 1. The category Optimize leads the initiatives, but in reality, there is very little difference between the four main categories, reflecting that the state of MGAs is very much in flux, with a holistic view on transforming, optimizing, and innovating the business to meet the increasing market, regulatory, and customer demands.

Within the four categories, the top five initiatives are:

- Entering new markets (8.2)

- Pricing and rating transformation (7.9)

- Improving customer experience (7.9)

- Expanding use of advanced data and analytics (7.7)

- Improving agent experience (7.7)

These all relate to the unique strengths of MGAs – niche products, underwriting expertise, and agent relationships. Accomplishing these to scale and optimizing the business requires technology investments, and leveraging next-gen architectures with native cloud, API first, microservices, headless, and embedded analytics.

Figure 1: MGAs’ Strategic Initiative priorities

Based on a 10-point scale, where 1 meant “Not at all important” and 10 meant “Very important”

MGA technologies can be their key differentiator. MGA tech tools unlock the ability to compete with large insurers and ensure profitable underwriting. Now, subscription-based pricing on cloud-native solutions that are based on DWP has offered more options for MGAs to create a technology foundation to transform and optimize their business, while giving them the tools of innovation. They can keep in step and advance beyond traditional operations with MGA product innovation and use advanced data and analytics to give them a competitive edge. The result is a greater value for their business, their insurance and reinsurance partners, agents, and customers.

With their increasingly important role, investment in a solid technology foundation is a must to minimize their own operational and financial risk. Staying ahead of the technology curve is mandatory in an increasingly data and tech-driven industry.

Do Budgets Match the Stated Priorities and Initiatives?

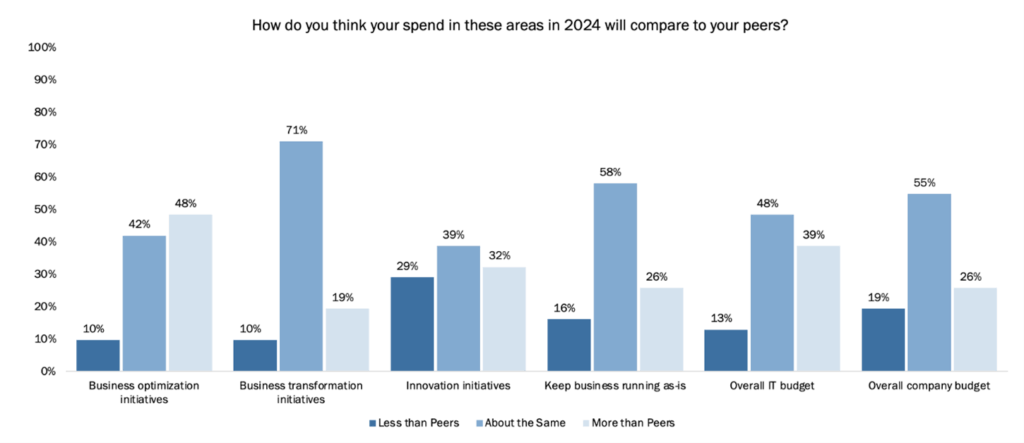

With increased focus on these strategic initiatives, it would be reasonable to expect that budgets would reflect these priorities. Unfortunately, there is a misalignment as they consider what they are spending in comparison to their peers, as reflected in Figure 2. Most appear to believe their budget is the same, except for business optimization, where they believe they are spending more than their peers.

Figure 2: MGAs’ expected 2024 spend compared to their peers

That is a questionable assessment, particularly given the number of PE (Private Equity) backed MGA startups and the number of MGAs acquired by PE firms that are raising the bar by creating significant value through the use of advanced data and analytics, along wit hnext-gen technology to create highly efficient, optimized and profitable businesses with better cost ratios, combined ratios, and business results in a highly fragmented MGA marketplace.

The biggest risk for an MGA is that the insurer’s relationship to be reduced or stopped, resulting in a lack of capacity to sell and underwrite their products. MGAs can minimize this risk operationally through increased spending on technology to truly transform, optimize, and innovate the business to remain relevant in a fast-changing industry.

Differentiating with Products & Value-Added Services

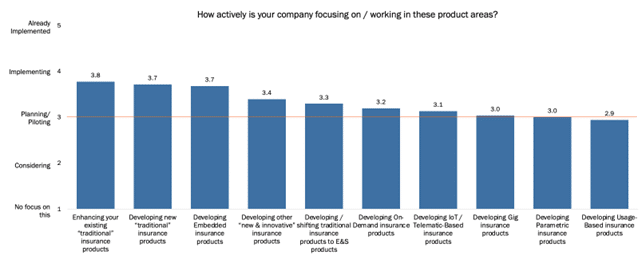

MGAs are keenly focused on new products, their “super strength.” MGAs recognize the challenges of today’s marketplace with increasing risk and the demand for both traditional and new products, as reflected in Figure 3. All of the product areas, with the exception of one, developing usage-based products, are above average, with rankings of 3.0 – 3.8. This bodes well for MGAs, with a positive long-term impact on customer and revenue growth.

They are positioning and differentiating themselves as leaders. They are ahead not only in traditional products, but also in developing other “new & innovative,” embedded, and E&S products — areas with continued growth opportunities that are being presented.

Figure 3: MGAs’ level of activity in developing products

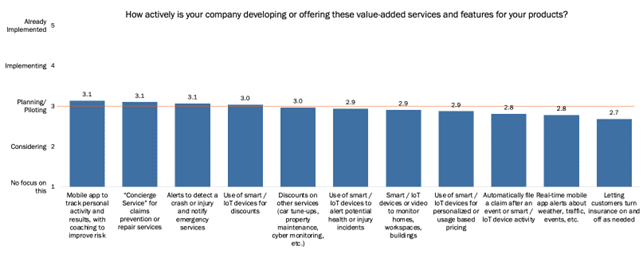

In contrast, value-added services do not rank as high as reflected in Figure 4. Only 5 of the 11 value-added services are above average, with a range of 3.0 – 3.1. Given the nature of MGAs’ focus on complex and niche risks, this is not surprising, as these services tend to be more valuable for traditional personal or commercial products like auto or property.

However, keeping an open mind to these as part of a product will be important as the demand for these continues to rise, as we have seen in the Majesco consumer and SMB research.

Figure 4: MGAs’ level of activity in developing value-added services

Tools of the Trade

Depending on the size, MGAs use either traditional insurer core solution suites or AMS solutions as the foundation for their operation and management of their products and book of business. As noted in the Datos Insights 2023 report, Property/Casualty MGA Core Systems: Overview and Solution Providers, these should include architectural elements, including Cloud/SaaS, single vs. multi-tenant, and APIs for integration.[i]

However, given the focus on digital experiences for agents and customers and data and analytics as competitive differentiators, the architectural foundation of core solutions should include all of the following elements:

- Cloud-Native Architecture: Leverage the full potential of cloud computing to enable scalable and containerized application creation and deployment. Experience enhanced scalability, elasticity, and automation, empowering the business to adapt swiftly to changing demands.

- Open API Standards Compliance: Seamlessly integrate with third-party services using adherence to Open API standards, ensuring superior interoperability and easy collaboration.

- Fully Headless Architecture: Embrace a completely headless approach for enhanced flexibility and adaptability. Respond swiftly to evolving market demands and user preferences, staying ahead of the competition.

- Microservices and Containerization: Benefit from isolated and portable application encapsulation, seamless scalability with microservices, enhanced resource efficiency, rapid deployment and rollbacks, DevOps enablement, infrastructure agnosticism, and improved security through reduced attack surfaces. Drive innovation, efficiency, and competitiveness in today’s fast-paced digital landscape.

- Embedded Analytics in Core: Integrated advanced analytics, including business intelligence, AI/ML models, and Generative AI, create an intelligentcore that propels insurers into the future of insurance innovation and customer-centric experiences with an ability to launch new products, value-added services, personalized experiences, and innovative channels.

Elevating MGAs’ business operations with a next-gen, intelligent technology foundation built on a robust next-gen architecture is now a must-have to compete and meet the digital demands of both today and tomorrow. It is a paradigm that signifies a groundbreaking leap in software design, fueled by the pillars of modern innovation: cloud-native, API-first, microservices, and containerization, headless, and embedded analytics.

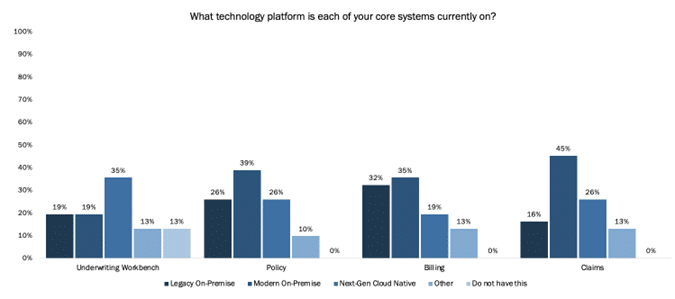

Unfortunately, many MGAs are well behind in moving to the Cloud, let alone leveraging the other technical architecture elements as seen in Figure 5. Only Underwriting Workbench stands out with just 38% on legacy or modern legacy on-premise solutions, as compared to policy, billing, and claims that have 65%, 67%, and 61% not in the Cloud, putting them at a significant disadvantage competitively. The shift to the Cloud is expected and necessary to support increasing operational demands, digital needs, and upgradeability to take advantage of innovations like GenAI.

As investors increasingly look to the MGA market, technology use will be a key factor in determining investment. (More on that below.) Likewise, as AM Best looks to assess and monitor the market, they too will be looking at the use of technology no differently than they do for insurers. This will put pressure on MGAs to move off their legacy solutions, sooner rather than later, to not being left behind.

Figure 5: MGAs’ current core system technology platforms

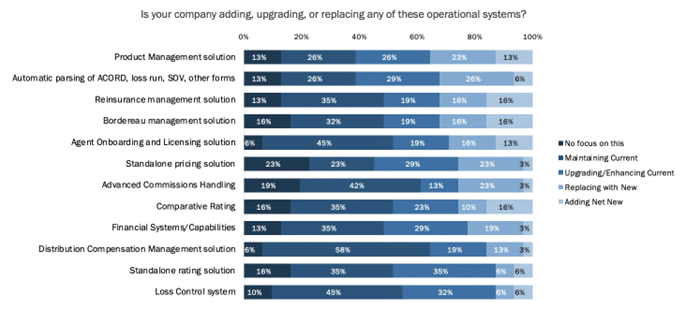

When looking into ancillary solutions beyond core, the top 5 areas of upgrading, replacing, or adding net new are heavily focused on their strength in products, pricing, and underwriting, as seen in Figure 6, including:

- Product Management

- Automatic parsing of ACORD, loss runs, or other forms

- Standalone pricing

- Reinsurance management

- Bordereau management

However, the second priority highlights the continued use of legacy solutions and the challenge of capturing this information in a data format that can be used with AI/ML models and more. Doing so would significantly improve data capture quality, consistency, and allow MGAs to do more with the data.

Figure 6: MGAs’ plans for changes to operational systems

Private Equity, Sustained Growth, and Caring About the Future

Priorities, of course, are subject to motives.

MGA executives are all over the map on the future of their organizations. Their motives are mixed. Many recognize that they are building to be acquired or infused with funding. Some are aiming for sustained growth with no plans for acquisition or funding. Others are simply attempting to partner well and utilize those partnerships as a strategy in their road to growth. Even though M&A is clearly listed in the MGA strategic priorities (See Figure 1 again) and it is on executive minds, the logic for technology improvement doesn’t change. Positioning for equity or acquisition is a matter of showing an attitude and aptitude for success in areas that insurers or Private Equity can’t reach otherwise. MGA’s expertise should be focused on the future of the organization and the products and services it provides. In any situation, technology will open the doors for MGAs to choose their future while they care about those they serve.

Is your organization an MGA or looking at MGAs as a vehicle for responding to new risks, growing channels, markets, and products in niche areas? Let Majesco show you how a cost-effective MGA technology investment can turn MGA strategic priorities into viable action and sustainable growth for the long term through our P&C Intelligent Core, P&C CoreConnect, and P&C Enterprise Rating solutions. Contact us today for more information or get a “strategic” peek at Majesco’s capabilities by viewing Majesco’s Spring ’25 Release Webinar, Innovation in Action.

[i] Weisberg, Eric, “Property/Casualty MGA Core Systems: Overview and Solution Providers,” Datos Insights, September 7, 2023, https://datos-insights.com/reports/property-casualty-mga-core-systems-overview-and-solution-providers/

The post New Technologies Energizes MGA Innovation Opportunities: MGAs Must Prioritize Strengths to Capitalize appeared first on Majesco.