Why More Insurance Agents Are Buying Books of Business in 2025

Key Takeaways

- Starting from scratch takes 12–24 months to break even, while book acquisitions generate cash flow in 60–90 days.

- Acquired books offer diversification, predictable revenue, and immediate access to commercial accounts.

- Seller financing and revenue-based payment models are making acquisitions more accessible.

- Due diligence is essential to assess risk, retention, and integration needs.

- Market timing and retiring agents make now an ideal time for agents looking to grow fast.

The insurance industry landscape has shifted dramatically over the past few years, and savvy agents are taking notice. While the traditional path of building a client base from the ground up remains viable, an increasing number of property and casualty and commercial lines agents are choosing a different route: acquiring established books of business. This strategic pivot reflects not just changing market conditions, but a fundamental evolution in how agents view growth, risk, and opportunity in today’s competitive environment.

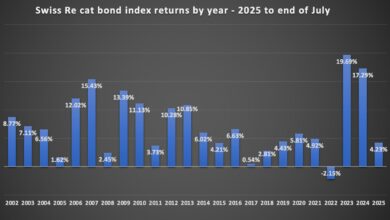

The numbers tell a compelling story. The number of unique buyers in 2024 was 98, which is 20% lower than the 122 reported for 2023 and 45% lower than the 177 reported in previous years, yet acquisition activity remains robust despite market fluctuations. This apparent contradiction reveals an important truth: while fewer players are in the acquisition game, those who remain are serious about leveraging book purchases as a primary growth strategy.

The Mathematical Reality of Starting Fresh

Let’s address the elephant in the room: starting an insurance agency from scratch is mathematically challenging in today’s market. New agents face what industry veterans call the “revenue valley of death” – that extended period where operational costs far exceed commission income. Traditional wisdom suggests it takes 18 to 24 months for a new agent to reach profitability, assuming they can generate consistent new business flow.

Consider the stark reality facing new P&C agents today:

- Revenue Stability Challenge: With average policy retention rates hovering around 85-90% industry-wide, new agents must write significant new business just to maintain revenue stability

- Rising Costs: Elevated customer acquisition costs continue to strain marketing budgets

- Regulatory Burden: Increased continuing education requirements demand time and financial investment

- Technology Investment: Substantial upfront costs for competitive management systems and rating platforms

Commercial lines present additional barriers for newcomers:

- Relationship Requirements: Commercial accounts typically demand established industry connections

- Knowledge Depth: Complex commercial risks require years of experience to understand properly

- Credibility Gap: Prospects often prefer agents with proven track records and client testimonials

- Longer Sales Cycles: Commercial decision-making processes extend significantly beyond personal lines

These combined challenges have created a scenario where acquiring an existing book becomes not just attractive, but often necessary for agents serious about achieving meaningful revenue quickly.

Calculate Your Break-Even Timeline

Before committing to either path, create a detailed financial model comparing 24-month projections for organic growth versus book acquisition. Include all costs: technology, marketing, compliance, and opportunity costs of delayed revenue. Most agents discover that quality acquisitions reach profitability 12-18 months faster than organic builds, even accounting for purchase costs and integration expenses.

The primary appeal of book acquisition lies in its ability to deliver immediate cash flow. Unlike the gradual build-up of a fresh start, purchased books provide day-one revenue that can support operational expenses and provide immediate return on investment. This revenue foundation allows agents to focus on optimization and growth rather than survival.

Recent market analysis reveals key timeline advantages:

- Cash Flow Speed: Well-structured acquisitions typically generate positive cash flow within 60-90 days

- Organic Growth Comparison: Traditional startup timeline extends 12-24 months to profitability

- Transition Benefits: Particularly valuable for captive-to-independent conversions and career changers

Revenue predictability from established books provides additional financing advantages:

- Lender Confidence: Banks favor proven recurring revenue over projected organic growth

- Better Terms: Acquired revenue streams often qualify for improved loan conditions

- Expansion Capital: Established cash flow supports future growth investments more readily

Our Problem: Too Many Leads, Not Enough Agents

Grow Your Agency Faster with Agency Height Insurance Directory

Grow Your Agency Faster with Agency Height Insurance Directory

Your email has been registered. Redirecting…

Join our network of successful agents and start getting quality leads

Risk Mitigation Through Diversification

Acquired books provide several risk mitigation advantages that organic growth cannot match:

- Historical Data: Loss ratios, renewal patterns, and client behavior provide performance insights

- Performance Predictability: Past results offer reliable indicators for future revenue stability

- Quality Assessment: Existing data allows informed decisions about portfolio strength

Market diversification benefits include:

- Instant Access: Immediate exposure to multiple industries and client segments

- Risk Distribution: Reduced vulnerability to economic downturns affecting specific sectors

- Geographic Spread: Opportunity to serve markets beyond organic reach

The learning acceleration factor proves particularly valuable:

- Experience Compression: Years of expertise gained through immediate exposure to varied scenarios

- Commercial Lines Mastery: Direct access to complex policy types and claims situations

- Client Management Skills: Inherited relationships provide real-world training opportunities

Market Conditions Favoring Acquisition

Several market factors have aligned to create particularly favorable acquisition conditions:

Demographic Drivers:

- Industry generational turnover accelerating as veteran agents retire

- Limited succession planning creating urgency among sellers

- Increased supply of quality books hitting the market

Economic Pressures:

- Overextended agents seeking to divest portions of their portfolios

- Cash flow challenges driving motivated seller behavior

- Operational complexity reduction priorities

Regulatory Impact:

- Compliance requirements creating operational burdens for smaller agencies

- Infrastructure upgrade costs pushing some agents toward exit strategies

- Desire to avoid regulatory complexity influencing sale decisions

These converging factors often result in books becoming available at valuations reflecting seller urgency rather than pure market maximization.

Track market signals like rising listings, longer sale times, and seller concessions to spot prime acquisition windows. The best deals often surface during market shifts or uncertainty, when sellers value speed over price. Set alerts by geography and business line to act fast.

Technology and Operational Efficiency

Modern insurance operations require significant technology investments that can strain new agencies. Management systems, customer relationship platforms, comparative rating software, and compliance tools represent substantial upfront costs that can delay profitability for startup operations.

Book acquisitions often include existing technology infrastructure and operational processes that would otherwise require months or years to develop. While integration challenges exist, the ability to inherit functioning operational systems provides immediate efficiency advantages over building from scratch.

The data assets included with book acquisitions also provide valuable insights for business optimization. Historical policy information, client communication preferences, renewal patterns, and cross-selling opportunities become immediately available rather than requiring years of data collection to identify trends and opportunities.

Financial Advantages and Creative Structures

It is rare for an independent insurance agency to have enough hard collateral to get a large enough loan to buy an existing book of business. However, creative financing structures have evolved to make acquisitions more accessible to individual agents.

Seller financing arrangements have become increasingly common, allowing buyers to structure payments based on revenue performance rather than requiring substantial upfront capital. These arrangements align buyer and seller interests while reducing the financial barriers that previously limited acquisition opportunities to well-capitalized buyers.

Revenue-based financing models, where payments are tied to commission production from the acquired book, provide additional flexibility for buyers while offering sellers steady income streams that often exceed lump-sum sale prices. These structures also provide natural performance incentives that benefit both parties.

Some acquisition platforms now facilitate direct connections between buyers and sellers, eliminating traditional broker fees and reducing transaction costs. This disintermediation has made smaller book acquisitions economically viable for individual agents who previously couldn’t justify the associated costs.

Due Diligence and Quality Assessment

Success in book acquisition requires thorough due diligence that goes beyond basic financial metrics. Smart buyers evaluate client retention patterns, policy mix quality, geographic concentration risks, and the underlying relationships that drive revenue stability.

Loss ratio analysis becomes critical when evaluating P&C books, as historical claims experience often predicts future profitability better than gross revenue figures. Commercial lines buyers must also assess the concentration risk associated with large accounts and evaluate the transferability of key client relationships.

The quality of documentation and policy administration practices within target books can significantly impact post-acquisition success. Books with poor documentation or lax renewal procedures may require substantial remediation efforts that offset acquisition advantages.

Technology compatibility represents another critical evaluation factor. Books managed on incompatible systems may require costly data migration and process restructuring that impacts integration timelines and costs.

Frequently Asked Questions

-

What is a book of business in insurance?

A book of business refers to the collection of clients and policies that an insurance agent or agency manages, including renewal income and customer relationships.

-

Is buying a book of business better than starting from scratch?

Yes, for many agents, acquiring a book is faster, less risky, and provides immediate income, while startups take longer to turn a profit and require extensive prospecting.

-

How much does a book of business cost?

The price varies based on client retention, revenue, risk profile, and location. Many deals use a multiple of annual commissions, typically 1.5x to 2.5x.

-

How do I finance an insurance book of business?

Options include seller financing, revenue-based payments, SBA loans, and buyer-seller matching platforms. Creative financing makes acquisitions possible even for newer agents.

-

What are the risks of buying a book?

Risks include client attrition, poor documentation, tech incompatibility, and integration failure. Strong due diligence and post-purchase planning are critical.