Insurers Top of Mind Issues Point to Shifting Technology Mindset

Complexity in insurance isn’t just a reality, it’s a disease. It attacks systems. It eats away at profits. It confuses experts and confounds customers. It often lurks undetected in the hidden corners of our business processes until financials, growth metrics, AM Best Ratings, customer and agent satisfaction, and operational challenges beg for a deeper look and point in the direction of the culprits. The most difficult thing about complexity, however, is that even when you know it’s in your system, it’s tough to get rid of it. And with an increasingly complex world, complexity grows each year. It can be difficult to find elegant solutions that simplify today’s complexities but easily adapt as they grow and shift.

The good news? These solutions exist, and insurers are increasingly seeking them out.

When we look back at 2025, we may consider this as the year that insurers “woke up” to their complexity-laden issues and started seeking solutions that both transform and simplify the business.According to Majesco’s 2025 Strategic Priorities report, insurer strategic priorities reflect a strong focus on establishing a new core technology foundation and optimizing the operational model to drive growth and profitability. The combination of technology, data and analytics and new operating model are integral to insurance business transformation built on a next-gen technical foundation and architecture that is a paradigm shift and a groundbreaking leap in software design. It is made possible by using the pillars of modern innovation: cloud-native, API-first, microservices and containerization, headless, and embedded analytics.

What caused the shift? How can insurers take their new mindset and make something of it quickly, in order to capitalize on the new architecture that will keep them competitive? For a deep dive, be sure to read Majesco’s Thought Leadership report, Strategic Priorities 2025: A Modern Era of Insurance Comes Into Focus.

Industry-Specific Challenges

Insurance business transformation can take different avenues. For example, even though P&C and L&AH have dramatically different core issues, they both need to focus on strategic priorities to emerge from challenges and leverage opportunities to grow. P&C and L&AH share many of the Top-of-Mind issues, and both segments are taking steps to rethink their business, simplify complexity, and address financials and growth by utilizing next-gen insurance technologies.

P&C Segment

The US P&C insurance industry has been challenged, being unprofitable the last few years, driven by inflation, supply chain issues, rising medical costs, social inflation (claims litigation costs), increased repair costs, and record catastrophic events resulting in a combined ratio well over 100, primarily due to auto and property business. A.M. Best estimates that catastrophe losses negatively accounted for 8.8 points on the nine-month 2024 combined ratio, which was before Hurricanes Helen and Milton, and most recently the California fires. In the last five years, the U.S. has had, on average, 18 separate billion-dollar disasters.

In response, insurers have aggressively pushed rate and pricing increases ranging from 10-50% each year to improve their underwriting and profitability metrics.However, the increases have a counter-impact on insureds, including decreased retention, increased customer shopping for lower prices, reducing coverages, increasing deductibles, or eliminating insurance coverage. This creates a growing protection gap of risk for individuals and businesses, which result in declining insurance trust and impacts the economy and government. This is unsustainable for everyone, and it begs for an insurance operating model transformation underpinned by next-gen technology that can drive down complexity and optimize operations.

L&AH Segment

The individual L&AH market has seen record growth driven by favorable interest rates that fueled record sales of individual annuities and variable products, boosting growth, profitability, and capitalization. This is different than a few years ago when interest rates were so low, and we had the challenges of COVID.

For group and voluntary benefits, increased medical and healthcare costs have created increased claims costs for some products and impacted enrollment for other voluntary or supplemental products due to rising costs for medical insurance, exacerbated by the impact of inflation on employee’s finances. In addition, the rapidly changing demographics of employees are shifting the focus to worksite and individual products that meet people’s changing behaviors and needs as they move between jobs.

L&AH individual insurers are focused on new products and new business models rather than legacy replacement. As a result, investments in next-gen insurance technology and advanced data/analytics are increasingly focused on new products and business models rather than legacy transformation. This is further reflected in L&AH insurers acquired by PE firms which are influencing investment in new technology for insurance, operational efficiencies, and channel expansion.

Industry Challenges

Insurance, on the whole, is in the midst of a business model and technology-driven change. Decades-old operational models and technology foundations no longer meet the challenges, demands, and opportunities of a fast-changing world. Just consider these every day operational struggles:

- time-consuming and manual workflows

- complex business processes that are fraught for error

- inconsistent customer and agent experiences

- increased litigation risks

- competition for talent attraction and retention

- lack of access to all operational data

- lack of business insights

- increased operational costs

Together, they are straining financial results and impacting product pricing, underwriting, customer satisfaction, and market competitiveness.

Executive Mindsets — What is Top of Mind?

What is both concerning and enlightening when we look at what is on executive minds?

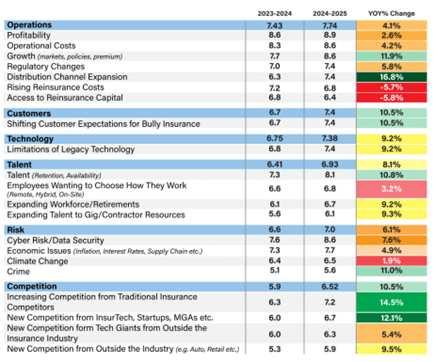

This year’s Top-of-Mind issues clearly reflect a focus on business operational and technology fundamentals. In comparison to the previous year, all issues (except for rising reinsurance costs) increased in intensity, with some jumping significantly, like talent, increased competition from traditional insurers, customer expectations and distribution expansion. This increased intensity reflects the challenging and changing marketplace as shown in Figure 1. These issues also reflect the reality of what happened in 2024 with inflation, increased risk, and challenging financials, which put a laser focus on the business foundation – operational model and technology.

Operational issues — such as profitability, operational costs, and growth — are still the top concerns year over year, with increases in importance including growth (up 11.9%) and Distribution channel expansion with the highest increase (up 16.8%).

Technology likewise jumped in importance by 9.2%, reflecting the increased challenges of legacy technology in an era of cloud, advanced data and analytics, and GenAI.

Figure 1: Insurers’ top-of-mind issues

Also of note is the concern of increasing competition from both traditional insurance competitors (+14.5%), InsurTechs, startups, and MGAs (+12.1%), and outside the industry (+9.5%). These concerns are well-founded, particularly given that the InsurTechs and competition outside the industry are not hindered by legacy technology, which puts them in a position to leverage next-gen solutions that can innovate the business model and products but also drive highly optimized operations that can influence pricing and competition positioning. Those existing insurers who have transformed to a next-gen solution find themselves in a position to accelerate their market position and differentiation with technology.

These organizations are leading as first-movers by strengthening their business fundamentals and foundations so they can rapidly and easily adapt and shift to the challenges of a changing market.

Optimism on the Horizon

Solutions now exist to tackle the complexity of these top-of-mind concerns. A next-gen, intelligent technology foundation built on a robust cloud-native architecture and embedded analytics including AI/ML models, GenAI and Agentic AI allows insurers to hone their focus and compete in today’s marketplace. With it, insurers can create an adaptable foundation for operational optimization and innovation that ultimately prepares insurers for relentless market shifts, customer and agent demands, and the fast-paced changing world of risk.

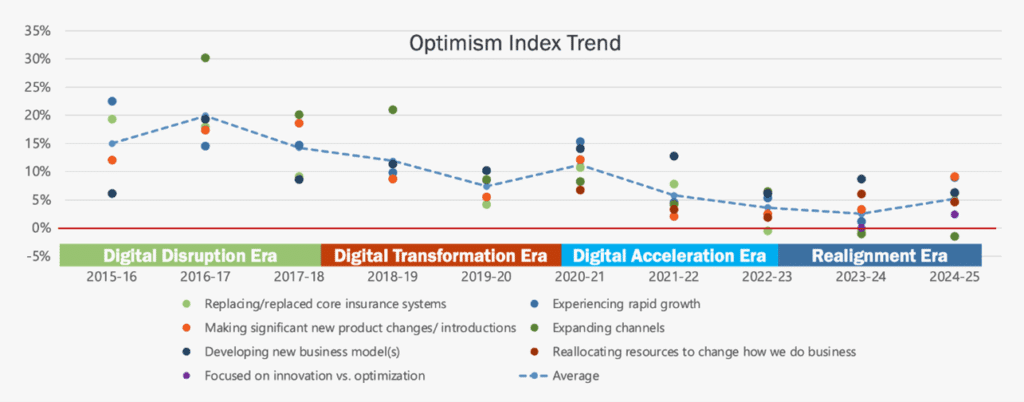

This shift to aligning the operating model and technology to meet the demands of a new era of risk is reflected in Figure 2, which highlights a shift in optimism from the last couple of years during what we have called the Realignment Era.

Figure 2: Optimism Index trend (The percentage increase/decrease in expectations for the next 3 years compared to the assessment of last year)

This era is redefining a way forward through innovation to elevate the business by optimizing and transforming with a greater focus on strategic activities that establish and strengthen a new business model and technology foundation that is crucial to drive stronger growth. Doing so requires leadership and fortitude to challenge the old ways of doing business.

The impact of this realignment is reflected in the rating for Growth expected in the next 3 years at 7.9 out of 10, an all-time high, indicating longer-term optimism.

Moving from top of mind to strategic priority

The pressures and challenges of macroeconomic factors, operating performance, increased risks, customer demands, and technology advancements are forcing insurers to recognize the compelling need to improve, both operationally and innovatively. Insurers need to create both immediate business results and long-term value for the customer. They need to transform their top-of-mind issues into strategies for action.

AM Best has been tracking innovation scores since 2019. In May 2024, a new AM Best report reviewed P&C insurer financials relative to their innovation score. The correlations are stunning and predictive. They prove the value of innovation. The report noted strong financial value for those with high innovation scores, including significantly higher NPW growth, lower expense ratios, and lower combined ratios. Furthermore, those considered non-innovators were overrepresented with downgrades.[i]

Those insurers focused on strategic priorities that drive innovation – from optimizing to transforming the insurance business model and technology – are demonstrating how it is making a difference in their financials but also as a leader in a modern era of insurance. Innovation is now smart investing. Mastering complexity and preparing for change is transformative.

Getting started

Whether or not you participated in Majesco’s Strategic Priorities Survey, you deserve to consider and list your own top-of-mind issues. Consider each item in light of what is now possible with technology. Are there solutions that can deal with one or many of your concerns?

Majesco’s own “predictive analytics” includes knowing what insurers need and will need for the coming decades. That’s why we’ve designed Intelligent Core next-gen insurance software solutions that will re-energize your efforts at optimization, innovation, and growth. With embedded data and analytics and onboard GenAI and Agentic AI automations, your teams will experience what it is like to improve, simplify and innovate faster than the speed of change. Contact Majesco today to learn more.

Also, don’t miss Majesco’s L&AH webinar next Thursday, July 31 at 12:00pm EST, Unlocking the Power of Majesco’s L&AH Intelligent Core Delivering Personalized, Agile and AI-Enabled Insurance Experiences. Also take a look at last month’s P&C webinar, Unlocking the Power of Majesco’s P&C Intelligent Core: A Deep Dive into Breadth of GenAI Use Cases for Policy, Billing, and Claims to Drive New Levels of Operational Optimization.

[i] “Highly Innovative Personal Auto Carriers Have a Significant Competitive Edge,” A.M. Best, May 2, 2024

The post Insurers Top of Mind Issues Point to Shifting Technology Mindset appeared first on Majesco.