6 Situations That Create Tax Liability • The Insurance Pro Blog

Life insurance has earned a well-deserved reputation as one of the most tax-advantaged financial vehicles available. The ability to grow cash value tax-deferred and access it tax-free has made whole life and universal life insurance popular choices for building wealth. However, it’s crucial to understand that not every life insurance transaction is tax-free.

As someone who has helped countless clients navigate the complexities of life insurance taxation, I want to share six specific situations where your life insurance policy could create unexpected tax consequences. Understanding these scenarios will help you avoid costly mistakes and make informed decisions about your policy.

1. Withdrawing Cash Value Beyond Your Cost Basis

The most common taxable event occurs when you withdraw more from your policy than you’ve paid in premiums. Here’s how it works:

When you pay premiums into your life insurance policy, you create what’s called a “cost basis” or “tax basis” in the contract. This represents the after-tax dollars you’ve invested in the policy. One of the beautiful features of life insurance is that you can withdraw your cost basis completely tax-free before touching any gains.

The Problem: If you withdraw beyond your cost basis, those distributions become taxable as ordinary income—not capital gains. This distinction is crucial because ordinary income tax rates are typically higher than capital gains rates, regardless of how long you’ve owned the policy.

What makes this worse: Once you take a withdrawal, you generally can’t reverse it. If you realize you’ve made a mistake and withdrawn gain instead of basis, you can’t simply put the money back.

How to avoid it: Always check with your insurance company to confirm your current cost basis before taking any withdrawals. If you’ve exhausted your cost basis, consider taking a policy loan instead, which doesn’t create immediate tax liability.

The Hidden Dividend Trap

Many policyholders unknowingly create tax problems by choosing to receive dividends as cash payments. Each cash dividend payment reduces your cost basis. If you’re not currently paying premiums (such as with a paid-up policy), you have no way to restore this basis.

Over time, especially with paid-up policies, you could exhaust your entire cost basis through dividend payments alone. Once this happens, all future dividend payments become taxable as ordinary income.

Pro tip: Dividend elections are typically locked in for the entire policy year, so you can’t change them mid-year even if you realize a tax problem is coming.

Accumulating Dividends at Interest

If you choose the dividend option to “accumulate at interest,” be aware that the interest earned on these accumulated dividends is taxable as ordinary income. This cash sits outside your life insurance policy and doesn’t enjoy the same tax benefits as cash value inside the policy.

2. Surrendering Your Policy

When you surrender (cancel) your life insurance policy, any cash value above your cost basis becomes taxable as ordinary income. While this might seem straightforward, there are several refinements that can catch you off guard:

- Certain policy riders may not count toward your cost basis

- The insurance company’s records of your cost basis may differ from your calculations

- If the insurance company takes longer than required to pay your surrender value, they’ll add interest—which is also taxable

Critical point: The insurance company will use their records to prepare the 1099 form sent to the IRS. Make sure you know what they have on file for your cost basis before surrendering.

3. Policy Loans Gone Wrong

Policy loans are often touted as a tax-free way to access your cash value, and they can be—but only if your policy remains in force until you die. If your policy lapses or you surrender it with an outstanding loan, the loan amount (including accumulated interest) becomes a taxable distribution.

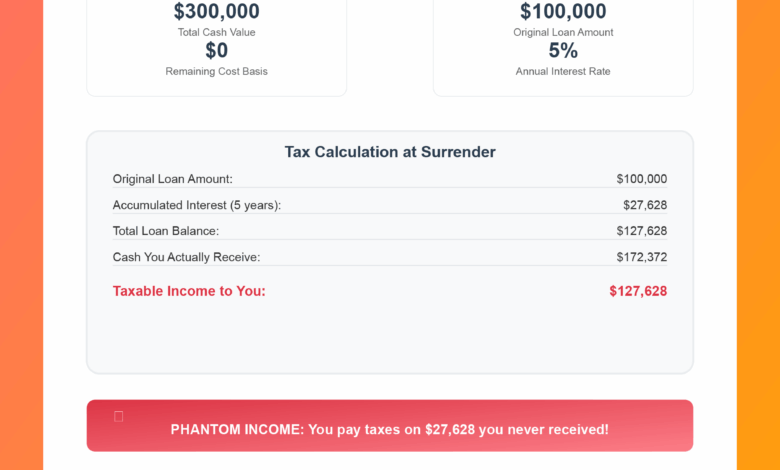

Here’s a real-world example: Suppose you have a policy with no remaining cost basis and $300,000 in cash value. You take a $100,000 loan at 5% interest. Five years later, you decide to surrender the policy without having made any loan payments. The accumulated interest is nearly $30,000, which means:

- You receive $30,000 less cash from the insurance company

- You still owe taxes on that $30,000 as if it were income, even though you never received it

This “phantom income” scenario can create a significant tax burden.

4. Modified Endowment Contracts (MECs)

If your life insurance policy loses its life insurance status and becomes a Modified Endowment Contract (MEC), the tax rules change dramatically:

- You lose the ability to withdraw your basis first

- All distributions (including loans) are taxed as ordinary income until you’ve withdrawn all the gain

- There’s no distinction between withdrawals and loans for tax purposes

Example: With a MEC having $100,000 in cost basis and $300,000 total cash value (so $200,000 in gain), a $50,000 loan would create $50,000 of taxable income immediately, plus any interest that accumulates during the tax year.

5. Death Benefit Complications

While death benefits are generally income tax-free to beneficiaries, certain choices can create tax liability:

Life Settlement Options

When beneficiaries choose to receive death benefits in installments rather than a lump sum, the insurance company holds onto part of the money and pays interest on it. This interest is taxable as ordinary income.

Retained Earnings Accounts

Many insurance companies offer beneficiaries the option to keep death benefit proceeds in an account with check-writing privileges. These accounts often pay attractive interest rates, but that interest is taxable as ordinary income.

Estate Tax Considerations

While death benefits are income tax-free, they’re not necessarily transfer tax-free. For large estates, life insurance proceeds are typically included in the estate for tax purposes unless the policy is owned by an irrevocable trust.

6. 1035 Exchange Boot Income

The most complex tax trap involves 1035 exchanges with outstanding loans. Here’s a scenario that trips up many policyholders:

You have a policy with an outstanding loan and want to exchange it for a new policy via a 1035 exchange. The new insurance company won’t allow you to transfer the loan, so you decide to surrender enough cash value to pay off the loan and then transfer the remaining cash to the new policy.

The problem: This creates “boot income”—taxable income that arises when you surrender cash value to repay a loan as part of a 1035 exchange.

Solutions:

- Use money from outside the policy to repay the loan

- Repay the loan through surrender, but wait at least 12 months before making the exchange

- Find an insurance company that will accept the loan transfer

Key Takeaways

Life insurance remains one of the most tax-advantaged financial tools available, but it’s not foolproof. The key to avoiding these tax traps is understanding the rules and planning accordingly:

- Monitor your cost basis regularly, especially if you take dividends as cash

- Consult with your insurance company before making any withdrawals or changes

- Avoid letting policies lapse with outstanding loans

- Be cautious with 1035 exchanges involving loans

- Consider professional guidance for complex situations

Remember, all taxable events related to life insurance are treated as ordinary income, not capital gains. This makes the tax bite potentially more severe than other investment vehicles.

The goal isn’t to avoid life insurance because of these potential tax issues—it’s to understand them so you can navigate around them and continue to benefit from this powerful wealth-building tool.

This information is for educational purposes only and should not be considered tax advice. Always consult with a qualified tax professional before making decisions that could affect your tax situation.