Understanding Waiting Periods in Health Insurance

When purchasing health insurance, many assume coverage begins immediately. However, most plans include waiting periods that delay access to certain benefits. These waiting periods vary by provider and policy type, making it essential to understand how they work.

In this article, we explore the concept of waiting periods in health insurance, including their purpose, types, and impact on coverage. We also cover the latest trends in health insurance, how to minimize waiting periods, and provide tips for selecting the right plan to suit your needs.

Definition of Waiting Period in Health Insurance

A waiting period is the time a policyholder must wait before specific benefits become accessible. During this time, claims related to those benefits are typically not accepted.

Waiting periods are a standard feature in health insurance policies worldwide. They serve as a buffer through which insurers assess the risk profile of new policyholders. This ensures that the policyholder is not seeking immediate coverage for pre-existing conditions or planned treatments.

For example, if someone purchases a health insurance policy to undergo surgery immediately, the waiting period prevents such scenarios, ensuring fairness and sustainability in the insurance system.

Purpose of Waiting Periods in Health Insurance

Insurers use waiting periods to prevent misuse and manage risk effectively. By implementing these periods, insurers can ensure that policyholders do not exploit coverage for pre-existing conditions or immediate high-cost treatments.

This approach helps maintain the financial stability of insurance providers and keeps premiums affordable for all policyholders.

Difference Between Waiting Period and Grace Period

While waiting periods and grace periods are both terms used in health insurance, they serve distinct purposes. Understanding these differences is crucial for policyholders to avoid confusion and ensure they meet their obligations while maximizing their benefits.

- Waiting Period: Refers to the time a policyholder must wait before specific benefits become accessible. During this period, claims related to those benefits are typically not accepted.

- Grace Period: Refers to the time allowed for policyholders to pay overdue premiums without losing coverage. During this period, the policy remains active, and claims can still be filed.

Common Misconceptions Around Waiting and Grace Periods

Terms like “waiting period” and “grace period” are essential in understanding health insurance coverage, yet they’re often confused with similar-sounding phrases. Here’s how to distinguish them—and avoid common pitfalls.

Misconception #1: Grace Period Means No Payment Necessary

It’s a common belief that a grace period allows you to skip premium payments without impact. This isn’t the case.

- A grace period allows temporary continuation of coverage if overdue premiums are paid within the stated timeframe.

- If payment isn’t made before the period ends, coverage is typically terminated, and reinstating it could mean penalties or even a new waiting period.

Elimination Period vs. Waiting Period

Both involve delays, but they serve different purposes.

- Elimination Period: Associated with disability or long-term care policies. It’s the period after an illness or injury before benefits start.

- Waiting Period: Refers to the time after enrolling in health insurance before certain benefits are available, like coverage for pre-existing conditions or maternity. Essentially, elimination periods are post-event delays, while waiting periods are pre-benefit holds.

Enrollment Window Confusion

An enrollment window is the designated time when individuals can sign up for or make changes to their insurance plan.

- It’s unrelated to grace periods and doesn’t apply to late payments.

- Missing an enrollment window might mean having to wait until the next open enrollment or facing penalties.

Coverage Lapse and Starting Over

Some assume that after a lapse in coverage, restarting a plan simply resumes previous benefits. This isn’t guaranteed.

- Reapplying after a lapse can trigger new waiting periods for certain benefits.

- A coverage lapse may reset eligibility, especially for time-sensitive or pre-existing condition coverage.

Different Types of Waiting Periods In Health Insurance

Health insurance plans often include several types of waiting periods, each tied to different conditions or benefits. These waiting periods are designed to address specific needs and circumstances, ensuring that coverage is tailored to the policyholder’s situation.

Here are the common types of waiting periods in health insurance:

- Accidental Hospitalization: Usually covered from day one

- Initial Waiting Period: Ranges from 0 to 30 days for general medical coverage.

- Maternity and Newborn Coverage: Typically 9 months to 3 years.

- Specific Illnesses: Conditions like hernia or cataracts may require 1 to 2 years.

- Pre-existing Conditions: Coverage may begin after 1 to 4 years, depending on the insurer.

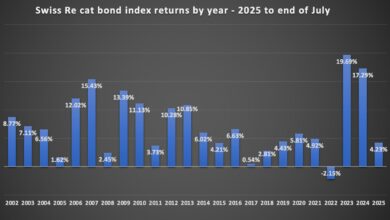

Updated Trends in Health Insurance

Insurers now offer shorter waiting periods for common conditions. Digital health records and predictive analytics enable providers to assess risk more accurately, resulting in flexible policies. Reduced waiting periods for chronic conditions like diabetes and hypertension are increasingly available.

Group vs. Individual Health Insurance

Group health insurance plans, commonly offered by employers, provide a unique advantage when it comes to waiting periods. These plans often include provisions that waive or significantly reduce waiting for new members, making them an attractive option for those seeking immediate coverage.

On the other hand, individual health insurance plans often impose standard waiting periods, which can vary depending on the insurer and policy type. It’s crucial for policyholders to carefully review the terms and conditions of their chosen plan to ensure it aligns with their healthcare needs.

Impact of Waiting Periods on Maternity and Family Planning

For families planning to have children, understanding maternity coverage is crucial for delivery costs, prenatal and postnatal care. Most health insurance policies impose a waiting period before maternity benefits are activated, typically ranging from 9 months to 3 years, depending on the provider.

This means early enrollment is essential for those anticipating family growth. Beyond delivery expenses, maternity coverage often includes:

- Regular prenatal checkups

- Ultrasound scans and screenings

- Hospital charges for childbirth

- Postnatal consultations and newborn vaccinations

Some insurers now offer maternity riders with reduced waiting times, especially for long-term policyholders or those who enroll during specific windows. Some family plans may bundle newborn health coverage, including immunizations and pediatric checkups during the first few months after birth.

Employers offering group health insurance may also provide more lenient terms on maternity benefits, with shorter waiting periods and broader coverage, making these plans especially attractive for young families.

Coverage for Pre-existing Conditions

Pre-existing conditions are medical issues diagnosed before purchasing a policy. Insurers often impose waiting periods to manage associated risks. These waiting periods help maintain fairness and sustainability within the insurance system.

However, newer policies offer innovative solutions to support policyholders:

- Partial Coverage Options: Some insurers provide limited benefits for pre-existing conditions during the waiting period, helping policyholders access essential treatments earlier.

- Wellness Programs: Designed to promote better health outcomes, these may include:

- Regular checkups

- Personalized fitness plans

- Preventive care services

- Tech-Driven Innovation:

- Digital health records enable more accurate underwriting

- Predictive analytics help tailor coverage and reduce waiting periods

How to Minimize Waiting Periods

Reducing waiting periods in health insurance is a key concern for policyholders seeking faster access to benefits. Strategies include choosing flexible plans, maintaining coverage, leveraging riders, and exploring group options.

These approaches ensure timely care and financial security:

- Choosing plans with shorter waiting times: Opt for policies that cater to specific needs and offer reduced waiting periods for common conditions. Look for insurers that specialize in flexible coverage options tailored to your health profile.

- Maintaining continuous coverage: Long-term policyholders often benefit from reduced waiting periods and additional perks. Continuous coverage demonstrates reliability and commitment, which insurers reward with favorable terms.

- Opting for riders or add-ons that accelerate access: Riders can provide faster access to essential healthcare services, bypassing standard waiting periods. Examples include maternity riders, critical illness riders, and wellness add-ons.

- Demonstrating good health through medical screenings: Insurers may offer favorable terms to individuals with lower risk profiles, including shorter waiting periods. Regular health checkups and fitness assessments can help you qualify for these benefits.

- Exploring group health insurance plans: Group plans, often provided by employers, may waive or significantly reduce waiting periods for new members. These plans are ideal for those seeking immediate coverage.

Expanding Coverage: The Role of International Health Insurance in Singapore

While understanding grace and waiting periods is crucial for domestic health plans, it becomes even more important when considering international health insurance.

These plans are designed to provide medical coverage across borders—ideal for expats, digital nomads, frequent travelers, and globally mobile professionals.

Why International Health Insurance Matters

- Global Access to Care: Ensures you’re covered whether you’re in Singapore, traveling in Europe, or relocating to the U.S.

- Customized Benefits: Includes options like emergency evacuation, outpatient services, mental health support, and chronic condition management.

- Flexible Portability: Plans often move with you, so switching countries doesn’t mean starting your coverage—and waiting periods—all over again.

Waiting and Grace Periods Still Apply

- Most international plans come with their own set of waiting periods, particularly for specific benefits like maternity or dental.

- Grace periods may vary by provider and country of coverage, so understanding the fine print is key to maintaining uninterrupted protection.

Working with a broker experienced in global coverage, such as Pacific Prime Singapore, can help you navigate these complexities with confidence.

Choose the Right Health Insurance Plan with Pacific Prime Singapore

Whether you need international health insurance, family coverage, or a plan tailored for expats, Pacific Prime Singapore is here to guide you every step of the way. With access to a wide range of options from leading insurers, our experts will help you find a plan that matches your healthcare needs, lifestyle, and budget.

We specialize in simplifying the complexities of health insurance, offering clear, unbiased advice and dedicated support, at no extra cost compared to going directly to the insurer.

Contact us today and let us help you secure peace of mind with the right coverage, wherever life takes you.