Find out how much private health insurance costs in the UK in 2025, backed by our latest independent pricing research from leading providers.

Why is the UK public turning to private health insurance?

Waiting lists and times in the NHS have been growing for some time, but the COVID-19 pandemic accelerated things. The result is record-breaking backlogs and people unable to get prompt medical treatment. An independent government report in September 2024 highlighted the scale of the issues, with problems in most parts of the country’s health system.

The latest figures from the NHS, up to August 2024, show that there were 7.64 million treatments pending, which is just under 20,000 more than in July. The number of people waiting more than one year is coming down, but at the current rate, it’d take around three years to clear it without considering new cases entering the system.

The waiting list figures most often mentioned in the press focus are for elective surgeries, such as hip or knee replacements. Alongside that, the NHS is struggling with cancer care, mental health, dentistry and GP services. So, there are plenty of reasons people are looking for other options to protect themselves and their families.

Average cost of private health insurance in the UK by age

Our latest research shows that the average monthly cost of private health insurance in the UK varies by age and cover level. A basic plan without out-patient cover costs £29 for a 20-year-old and £141 for a 70-year-old. A comprehensive plan with out-patient cover ranges from £41 to £203.

The table below compares the average cost of private health insurance by cover level and age in the UK:

Key findings:

- The average monthly cost of basic health insurance (without out-patient cover) for a 20-year-old is £28.79, while comprehensive cover (including out-patient cover) costs £41.24.

- By age 70, the monthly cost of basic health insurance rises to £141.29, with comprehensive cover reaching £202.51, reflecting the significant impact of age on premiums.

- Health insurance premiums increase steadily with age, with comprehensive plans typically costing 40-50% more than basic plans.

Want to know more?

Read our guide that compare how claims affect renewal premiums

What impacts the cost of private medical insurance?

Several key factors, including the cover level of your plan, your age, the cost of medical treatment, and, in some cases, your health, influence the cost of private health insurance in the UK. Additionally, your claims history, overall claims made by members, and smoking habits can also affect premiums.

Prefer to read?

Here’s a summary of the key factors what impact the cost of private medical insurance:

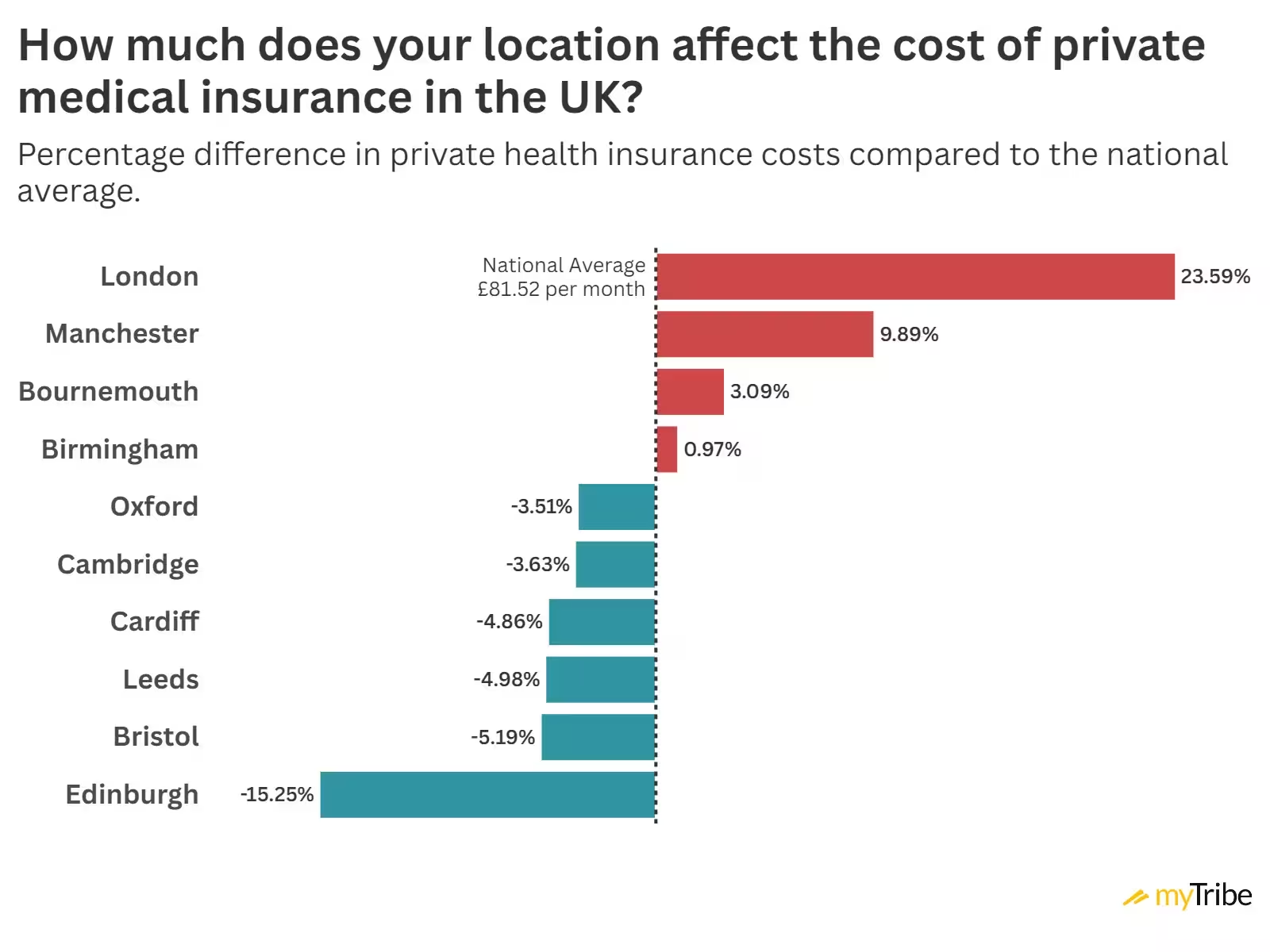

Most private health insurance companies change their prices based on where you live in the UK. The primary reason for that is that the cost of private medical treatment varies around the country, with claims costing different amounts depending on the location of the hospital you use. Insurers also factor things into the price like the frequency of claims in a specific postcode and how many people have medical insurance in an area.

Overall price difference by town and city of the UK

The bar chart below compares the towns and cities we sampled against the national average cost for private medical insurance. It includes data from all age groups, providers, and policy types, to give you an overall view of which towns and cities are the least and most expensive.

How price varies based on location for different age groups in the UK

The table below is a detailed comparison of health insurance premiums across major UK cities broken down by age.

Note: The average costs provided in the above table cover all ages, from 20 to 70 years old, and are meant to illustrate how prices vary based on location, not give an indicative price for your policy.

Key findings:

- London is the most expensive place to get health insurance in the UK, with premiums costing on average 23.6% more than the national average.

- Edinburgh is the cheapest location, with premiums 15% lower than the national average.

- For example, the average cost of health insurance for a 50-year-old in Edinburgh is £62.35 per month, compared to £93.40 for someone in London.

Average cost of medical insurance by insurer

The cost of private medical insurance will also be affected by the insurer you choose. Our research found that there isn’t a consistent “cheapest” insurance company, as it also depends on your age and where you live.

It may also be that an insurance provider that charges a bit more is a better fit for you, so while we’re here to share what we’ve found in our research, we need to point out that it’s tough to compare the insurers here as what they each offer differs.

The table below shows how prices from Aviva, Axa Health, Bupa, Freedom, The Exeter, Vitality and WPA compare for a comprehensive policy which includes some out-patient cover.

Important notes:

- Several of the providers we sampled (Freedom, National Friendly and WPA) do not offer a “guided consultant” list, and therefore, the pricing we’ve received from those will give you access to a wider pool of medical specialists. All providers will allow you to pay more to have non-guided consultants, but the pricing from these four include it by default.

- Please see our full methodology for more information on policy configuration.

One insurer we sampled doesn’t change their premiums based on where you live

Freedom Health Insurance is the only insurer we looked at that didn’t adjust its pricing based on where you live. So whether you live in London or Edinburgh, your price will be the same.

Some time ago, we asked Freedom Health Insurance why they take a different approach than most health insurance providers, they told us:

The other exception to the postcode rule

While Freedom is the only health insurance provider we looked at that will keep your pricing the same based on your address, National Friendly also stands out in this respect, with less pricing variation than others. Of the ten towns and cities we looked at, they only adjusted pricing for customers in London and Manchester.

How much do you save by adding extra people to your policy?

Health insurance providers often give discounts for multiple people on the same policy, be that another adult or if you add your children. A joint or family health insurance policy will cost more than a plan for an individual as you’re covering more people, but they can be cheaper than taking out separate policies.

Currently the insurers that offer discounts for joint policies and family cover are:

- Aviva – only pay for your eldest child, up to the age of 20 years old

- Bupa – 5% off for a joint policy, only pay for your eldest child, up to the age of 20 years old.

- Vitality – Only pay for your eldest child up to a maximum of three children

- The Exeter – 5% discount for joint policy, 8% for families*

*This isn’t advertised by The Exeter but is visible when requesting a quote.

What is the average cost of health insurance for couples?

While some insurance providers will give you a discount for getting a health insurance plan for two adults, it’s not always the case. Depending on what you and the other person are looking for from a health insurance plan, buying separately from different insurance providers is something to consider.

Aside from the potential of a slight discount, having two people on the same health insurance policy will reduce the admin needed and avoid needing to shop around for two plans each year.

The table below shows the findings of our most recent research into the average cost of private medical insurance for couples:

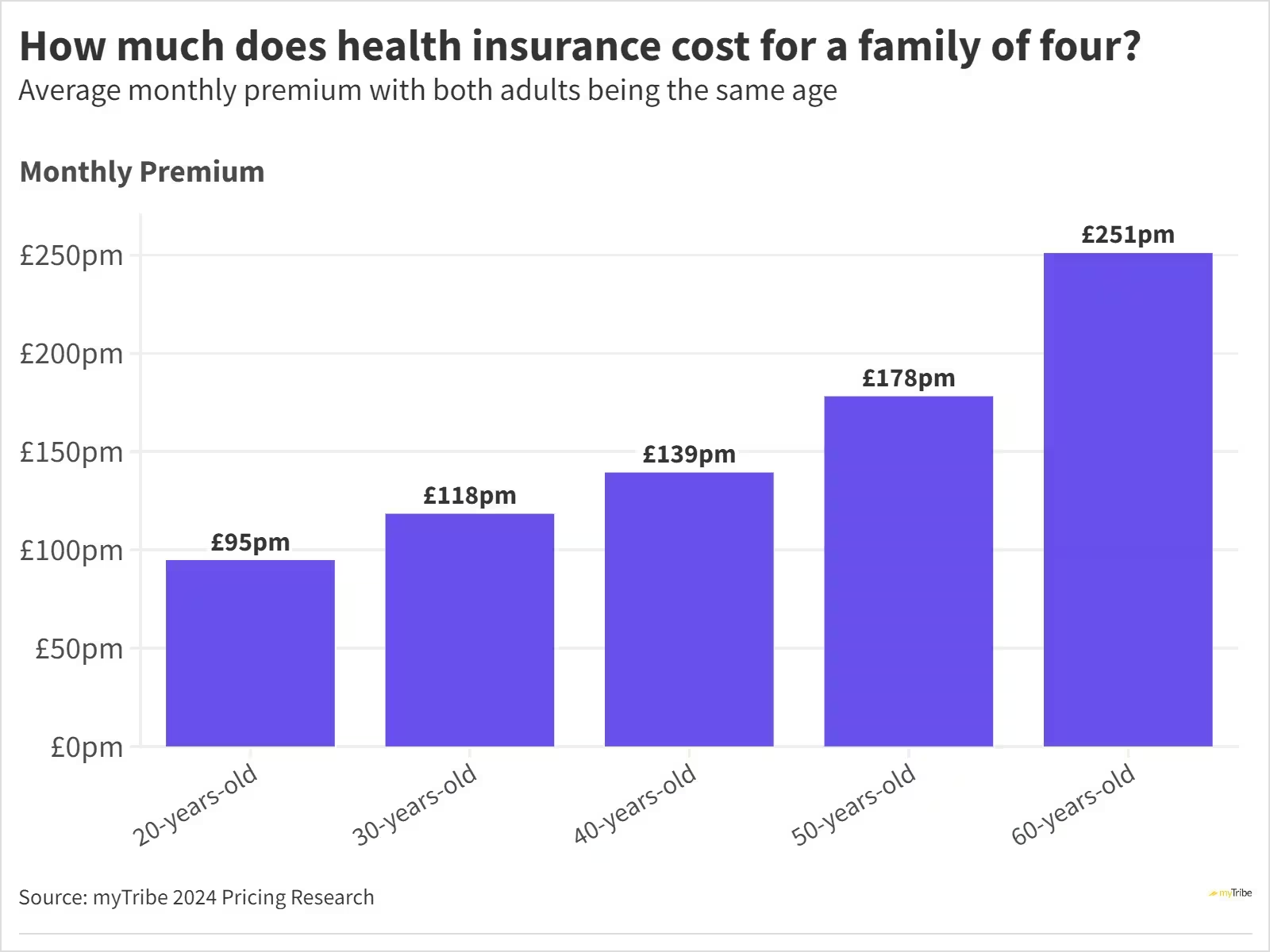

What is the average cost of family health insurance?

Our most recent research shows the average monthly cost of private health insurance for a family of four is £166.75.

As with an individual health insurance policy, the cost of family health insurance will vary depending on the ages of the family members, your cover level, where you live and whether everyone is in good health.

The graph below shows the average cost of family health insurance based on the ages of the adults in the family:

To find out how much family health insurance would cost for you and your tribe, please request a quote, and an experienced and highly-rated broker will compare the leading health insurance companies for you.

Is health insurance more expensive for smokers?

People who smoke or have used nicotine replacement products such as vapes, patches or gum in the past couple of years will usually pay a bit more for medical insurance. However, it’s often not a substantial increase, unlike what you might see with life insurance.

You will be aware that if you smoke, you’ll be at a higher risk of many serious medical conditions. While the initial cost of your health insurance won’t be affected too significantly, if you develop health issues as a result of smoking, you’ll likely need to claim on your policy, which could push up renewal premiums.

For information about stopping smoking please visit the NHS website.

Is health insurance more expensive if you have pre-existing medical conditions?

Private health insurance can be more expensive if you have pre-existing medical conditions, as some companies offer discounts of between 10-15% if you have a clean bill of health.

If you have pre-existing medical conditions or a complex medical history, you should speak with a broker before getting health insurance. An expert broker will help you choose the right type of medical underwriting and also advise you on which private health insurance companies are worth considering based on your pre-existing conditions.

What is the cheapest type of private health insurance?

The cheapest type of private medical insurance is a policy that gives you core cover, without any additional options applied. Sometimes called “Treatment only” or “Basic plans”, they offer excellent benefits but won’t include everything a comprehensive policy would. Most entry-level health insurance policies will cover:

- In-patient and day-patient in a private hospital

- Out-patient surgery

- Cancer treatment and care

- Some complex scans, such as MRI, CT and PET Scans

- Virtual GP services

- In some cases, physiotherapy

Cheap vs. more expensive private health insurance

With a cheap health insurance policy, you’ll usually need to be diagnosed before claiming private treatment. So you’d either need to seek a diagnosis via the NHS or self-pay to go private. As people get older, they often consider reducing their cover level, eliminating some of the “nice to haves” but retaining the core cover to keep control of premiums.

The table below shows who our researchers found to be the cheapest insurers, for the age groups we looked at:

9 ways to reduce the cost of your health insurance

So far in this article, we’ve outlined the factors which affect the price of private health insurance policies, along with some example pricing, but what if you want to reduce the cost? This section covers most of the ways we can help you to reduce the cost of private medical insurance:

1. Limiting your out-patient cover or removing it entirely

If you want to significantly reduce the cost of your health insurance and have out-patient cover, you could review how much you need moving forward. This option isn’t appealing to many people, as they want continued out-patient cover. However, you could add benefit limits to your policy to reduce costs. For example, you could limit your annual out-patient allowance to £1,000, which will reduce your premiums without completely sacrificing the benefit.

2. Opt for a higher policy excess

Probably the most straightforward solution to reduce the price of your health insurance is to increase your policy excess. While this is simple and easy to do, we do always suggest caution in this respect, as no one likes to be faced with a hefty bill when they are unwell. You should also be careful, as if invoices for treatment fall across two plan years, you may have to pay your excess twice!

3. Choose a guided consultant option

While all the insurers will allow you to choose a hospital list, i.e., the hospitals you can use, another option is “guided consultants”. With a guided option, you agree (for a reduction in your premiums of around 20%) to have your insurer suggest 2-3 specialists and the hospital you should use should you require medical treatment.

How it works and what it’s called varies between providers. Bupa gives you more flexibility than others, but be aware that choosing a guided option reduces the pool of medical specialists and facilities you can use.

4. Always compare providers, especially at renewal time

Shopping around is hugely important. You’ll often find that you can save considerable money by switching providers at renewal time. The quickest and easiest way to do this? With a broker. They do the leg work for you and will be able to save you considerable time and likely money, too!

5. Quit smoking

If you’re a smoker, your health and other insurance premiums, such as life insurance, may be higher. By quitting smoking, you will enjoy better health and may be able to reduce your insurance premiums for these products.

6. Remove supplementary cover

There can sometimes be supplementary or optional cover added to a policy that isn’t needed. We recommend looking at your policy in detail to see whether you actually need everything that has been included; perhaps you have something like mental health cover that you’ve never used and don’t feel you need any longer or another add-on.

7. Review your underwriting method

The main types of underwriting used for private medical insurance are Moratorium and Full Medical Underwriting, and changing the method used can sometimes yield savings. A word of caution, though: changing your underwriting method must be done carefully not negatively to affect what’s covered by your policy.

8. Add a 6-week wait

You can add a 6-week NHS wait clause into the policy, which effectively says if the waiting list for the treatment you require is less than six weeks on the NHS, you will go down that route rather than opting for private medical care. It’s an effective way of reducing the cost of policies, but it does sacrifice your level of cover.

9. Speak to an expert

Finally, you should speak to a qualified expert to ensure you have the best policy for the best price, which covers you for what you need but no more. Request a comparison quote below, and we’ll put you in touch with one of our highly rated brokers.

What are the alternatives if I can’t afford health insurance?

If health insurance isn’t an option for you due to the cost, you can access private healthcare in other ways.

Cash plans

A cash plan is a bit like a savings account in that you pay a monthly fee, typically between £ 20 and £60. When you incur private healthcare costs such as visits to your dentist or opticians, your plan will give you cashback towards some or all of the cost. Cash plan prices don’t change based on your age, and they also don’t exclude pre-existing conditions.

Cash plans won’t usually cover you for major treatments, like surgery or cancer care; they’re for routine, day-to-day healthcare costs.

Self-pay for private medical care

Health insurance is just one way to pay for private healthcare, and you can pay out of your own pocket if you’d like to. The benefit of this is that you’re only paying for what you need when you need it. The downside is that if you need major surgery or cancer treatment, the cost can run into tens, sometimes hundreds of thousands.

If you decide against private medical insurance, “self-insuring” might be a good idea. If you self-insure, you put money aside each month that otherwise would have been paid to a health insurance company so that should you need private medical care, you have a pot of money that can be used towards it.

NHS Right to Choose

Many people consider health insurance if they have a health concern they want help with. Unfortunately, as all health insurance policies will exclude pre-existing conditions from at least the past five years, private health insurance won’t help much.

Under NHS Right To Choose, you as a patient have the right to say to your GP that you’d like to use a different hospital, whether that’s NHS or private. The only stipulations are that the hospital has to be providing services to the NHS already, and the cost of treatment mustn’t be more than it’d cost in the NHS.

Closing thoughts

Private health insurance is a complex financial product that can be configured in many ways. Because of this flexibility, obtaining a meaningful average can be challenging. While all private health insurers offer slightly different products, we’ve done our best to minimise the variables and provide guide prices.

Our data sample

For this research, we focused on the cost for individuals, couples, and families, with the adult applicant being aged 20, 30, 40, 50, 60, or 70 years old.

For each of these ages, we obtained quotations from 10 towns and cities across the UK: Birmingham, Bournemouth, Bristol, Cambridge, Cardiff, Edinburgh, Leeds, London, Manchester, and Oxford.

Additionally, we gathered quotes from eight of the best private health insurance providers—WPA, The Exeter, AXA Health, Freedom, Bupa, National Friendly, Vitality, and Aviva—for policies both with and without out-patient cover.

Private medical insurance quote configuration

To ensure consistency, we had to determine what level of cover our fictional applicants would need to get quotes from each of the eight insurers. Working with external health insurance brokers, we created a list of policy requirements to reflect what a typical basic and comprehensive policy might include. In short, these were:

- Basic Policy: Configured with no additional out-patient or therapies cover.

- Comprehensive Policy: Included out-patient cover limited to £1,500 per year, along with Therapies Cover.

- Policy Excess: Set at £250 (or as close as possible).

- Mental Health Cover: Excluded, except for Bupa, which includes it as standard.

- Hospital List: Defaulted to the insurer’s standard hospital list.

- Additional Cover: Excluded Dental, Optical, and Travel Cover.

- Underwriting: Policies were underwritten on a moratorium basis.

- Consultant List: Opted for a guided consultant list, although several insurers (WPA, Freedom, and National Friendly) do not offer this.

Data sources:

Aviva Website (June 2024)

Axa Health Website (June 2024)

Bupa Website (June 2024)

Freedom Website (June 2024)

The Exeter Website (June 2024)

Vitality Website (June 2024)

WPA Website (June 2024)

Disclaimer: This information is general and what is best for you will depend on your personal circumstances. Please speak with a financial adviser or do your own research before making a decision.