As your health insurance nears its renewal, you’ll want to review your options and ensure you’re still getting the best deal. In this post, our experts outline how best to manage your health insurance renewal and when switching providers does and doesn’t make sense.

Why it’s important to review your health insurance at renewal time

Each year, as you age, your health insurance premiums will rise to account for the increased probability of claims and other factors, such as higher treatment costs owing to medical inflation. If you’ve claimed on your policy in the past year, you’ll likely find the increase will be higher, especially if it’s affected your no-claims discount, albeit that isn’t always the case – it varies from insurer to insurer.

How much do health insurance prices rise as we get older?

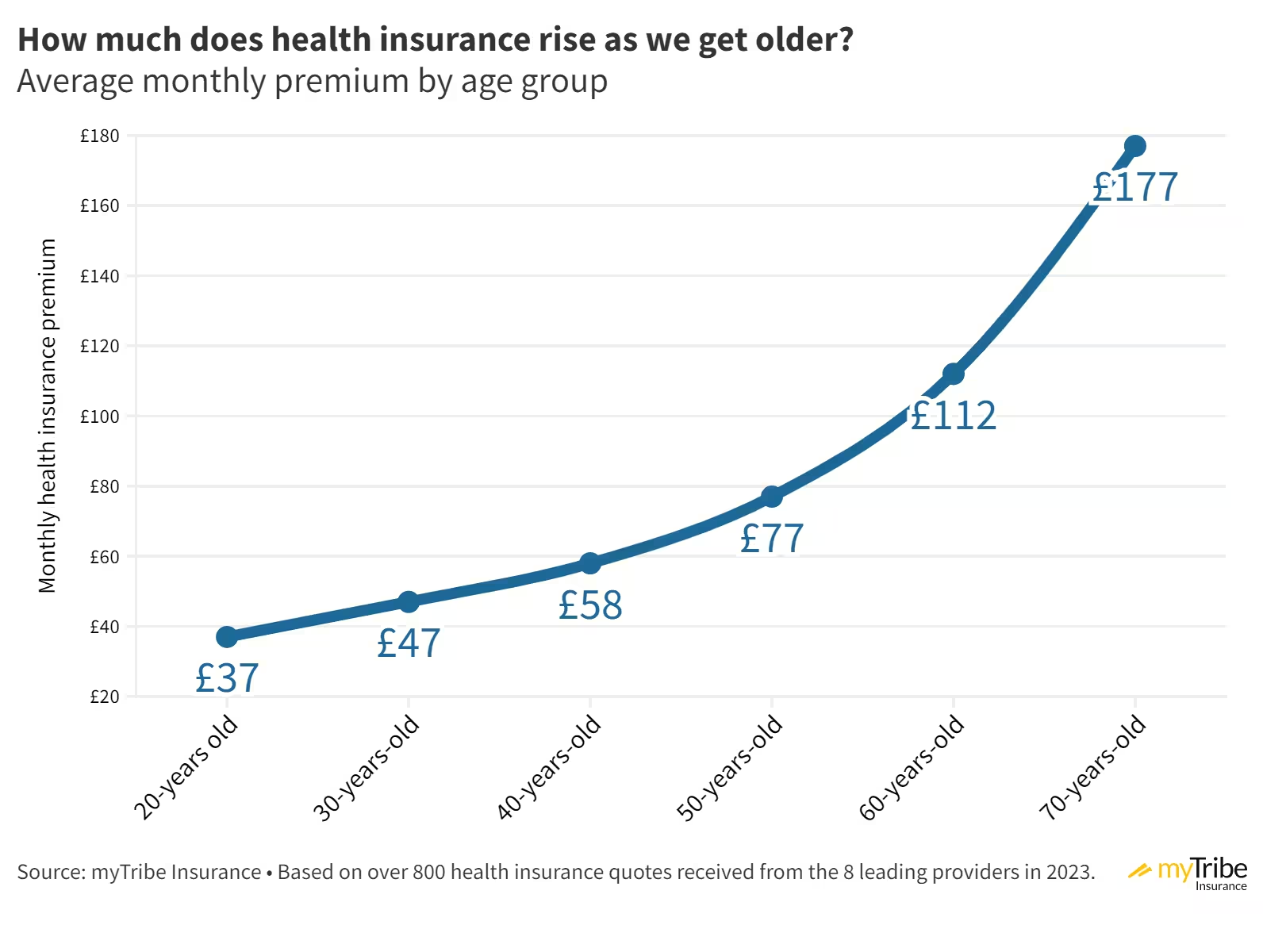

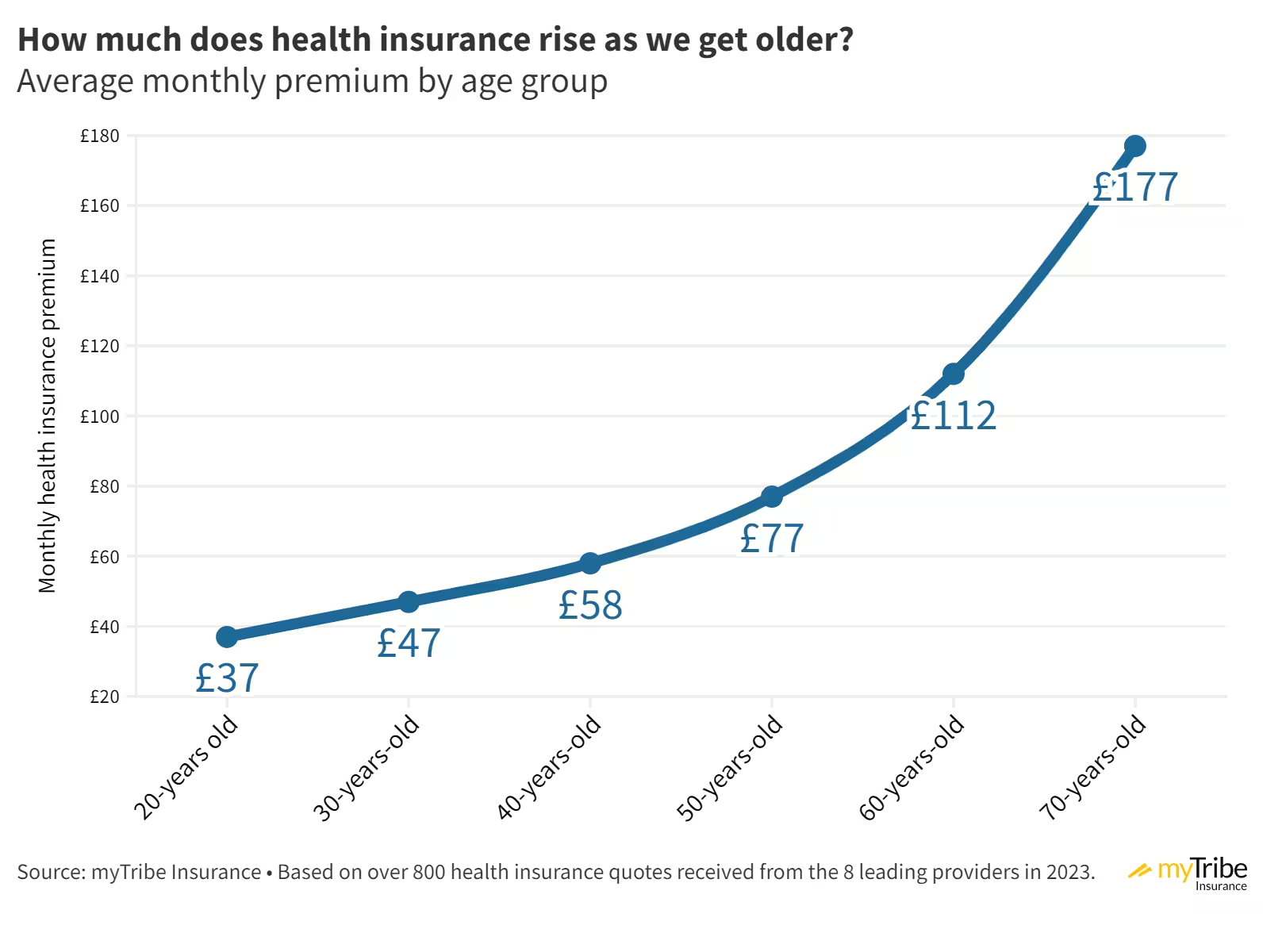

At the start of 2024, we researched the average cost of private health insurance obtaining over 800 quotes for what we consider a typical comprehensive policy.

Some takeaway stats from our research:

- The cost of health insurance for a 40-year-old is approximately 56% higher than the same policy for a 20-year-old.

- As we pass 40, the price increases rise more steeply, with a 32% increase between 40 and 50 and another 45% increase between 50 and 60.

- Perhaps unsurprisingly, the steepest rise is between 60 and 70 years old, with premiums rising by 58% in a decade.

The graphic below shows the results of this research, which is helpful as a guide to see the approximate costs for each age group.

Disclaimer: The prices shown in the infographic below are averages based on a large data sample, and your policy price will differ based on your age, cover levels, location and many other factors. If you want an accurate comparison quote, please request one by clicking here.

*Average based on quotes from eight leading health insurers in 10 UK cities for a NEW policy. We opted for a comprehensive policy, with a £250 excess (or as close as possible), outpatient cover limited to a maximum of £1,500 in claims per year, and we included therapies cover. We defaulted to each provider’s standard hospital list and used moratorium underwriting. Mental health cover, dental, optical and travel cover were all excluded. Prices are accurate as of 05th January 2023. Please note these prices are purely illustrative; the cost of your policy will be different.

You may be able to get better terms at a better price elsewhere.

Health insurers are eager to win your business and continually offer different incentives, discounts and offers to tempt you to switch. You might be able to get improved cover for less money with another insurer, but you won’t know until you check. This is especially true if you’ve been with the same insurer for several years, there may be far better options available to you.

Steps for renewing your health insurance with your existing provider

The exact process for renewing your health insurance will differ based on the provider, but the following is a general sequence of events:

- Initial contact from provider: Your current insurance company gets in touch with you as your policy nears its renewal date. They might provide you with a renewal quote instantly or share details on how you can contact them to discuss policy renewal.

- Assessment of existing policy: At renewal, your provider closely examines your current policy. Factors like changes in your age, the influence of medical inflation, and the effect of any previous claims may affect the premium for your renewed policy.

- Provider’s decision: After the provider has evaluated your renewal, they consider any adjustments made, impacts on the policy, and changes you have requested. Subsequently, they inform you about any alterations in the premium and the available options.

- Your decision: The final call lies in your hands. You can either accept the renewal terms or choose a different provider if the new policy doesn’t meet your expectations or requirements.

We strongly recommend comparing other insurers at renewal and speaking with an experienced broker before making a decision. It may seem like the simple option to just renew with your existing provider, but there could be savings to be had by shopping around or potentially better cover options.

Don’t switch until you speak with a broker

If you already have a health insurance policy, you should be familiar with how underwriting works and that pre-existing conditions are usually excluded from new policies. Before you think about switching, please consider whether any health complaints you’ve suffered from will become excluded by making a move. It’s not a decision to rush into, so we recommend allowing time to think about it and look at your options, and you should always consult with an experienced broker and get unbiased advice.

Can you switch without introducing new exclusions?

Each provider has set medical switch questions and criteria to ensure a safe transfer without detriment to past history. So long as you answer those questions truthfully and meet their criteria, you should be able to switch without penalty. Leading brokers also often have some sway with the insurers and can ask them to have a second look at exclusions to see if there is any wiggle room to review.

Top tip – it’s essential you speak to an experienced broker before switching. Brokers will tell you whether it’s safe to move at renewal or if you’d be better to stay put!

When is the best time to review your policy?

While your current health insurance provider will notify you around 30 days before your renewal, thinking about your options ahead of this is often wise. The last thing you want is to be hurried into a decision due to an impending deadline, so we recommend reviewing your options a good 60-90 days before your renewal is due.

How to request a free health insurance renewal review with myTribe

- Request a health insurance comparison quote using one of the buttons on this page or by clicking here.

- One of our highly-rated, vetted and FCA-authorised brokers will review your requirements and conduct a market review.

- They’ll be in touch to talk the options through and discuss whether it’s worth and safe to switch.

- You decide what you’d like to do, stay with your current provider, or proceed with a switch.

Bupa health insurance renewal process

Bupa will write to you at least 28 days before your health insurance renewal date, and unless you decide to end your cover, it will be automatically renewed.

If you’re an existing Bupa customer, you can contact them by calling 0345 6090 111 or visit this page on their website.

Axa Health renewal process

Axa will get in touch 3 – 6 weeks before your health insurance is due to renew, and similarly to other providers, they will auto-renew your policy if you don’t choose to cancel.

You can contact Axa Health on 0800 015 6204 or by visiting this page on their website.

Aviva Healthier Solutions renewal process

Aviva will contact you at least 30 days before your policy is due to renew and allow you to make changes to your policy and let you know if they would like to make changes.

You can contact Aviva by calling 0800 068 3827 or visit this page on their website to log in to your account.

Vitality Health Insurance renewal process

Like the other insurers mentioned, Vitality will contact you before your policy is due to renew to allow you to make changes and inform you of any adjustments from their site.

You can find out more about how Vitality calculates its renewal rates here, or you can call them on 0808 115 6084 to speak about your policy.

WPA renewal process

WPA will contact you before your policy is due to renew, allowing you to make amendments and let you know of any changes from their perspective.

You speak to WPA about your policy by calling 01823 625230 or visiting this page on their website.

Freedom Health Insurance renewal process

If you have a Freedom Health Insurance policy, they will contact you before your policy is due to renew to discuss options with you.

You can contact them by calling 01202 756350 or by visiting this page on their website.

Disclaimer: This information is general and what is best for you will depend on your personal circumstances. Please speak with a financial adviser or do your own research before making a decision.